Technology for Working Capital Optimization

- Date:October 15, 2013

- Author(s):

- Amy Hoke

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

New research from Mercator Advisory Group examines how technology is facilitating payments discounting and supply chain financing

Advancements in the technology for electronic accounts payable (EAP) solutions have come to the aid of companies looking to optimize their working capital.

Mercator Advisory Group's newest Research Report, Technology for Working Capital Optimization, examines how cash management is benefited by solutions in the market place that facilitate business-to-business payments. These solutions help companies optimize their working capital by providing technology that supports dynamic discounting and supply chain financing.

"The need for tight cash flow management and visibility into spending is critical to running a profitable business," comments Amy Hoke, Director of the Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group and author of the report. "Optimization of trading relationship contracts, payment terms, and speed of payment can yield a significant cash management benefit for buying and receivable organizations."

This report contains 21 pages and 12 exhibits.

Companies mentioned in this report include: Ariba, Bora Payment Systems, Direct Insite, Hap-X, PrimeRevenue, Taulia

Members of Mercator Advisory Group's Commercial and Enterprise Payments Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

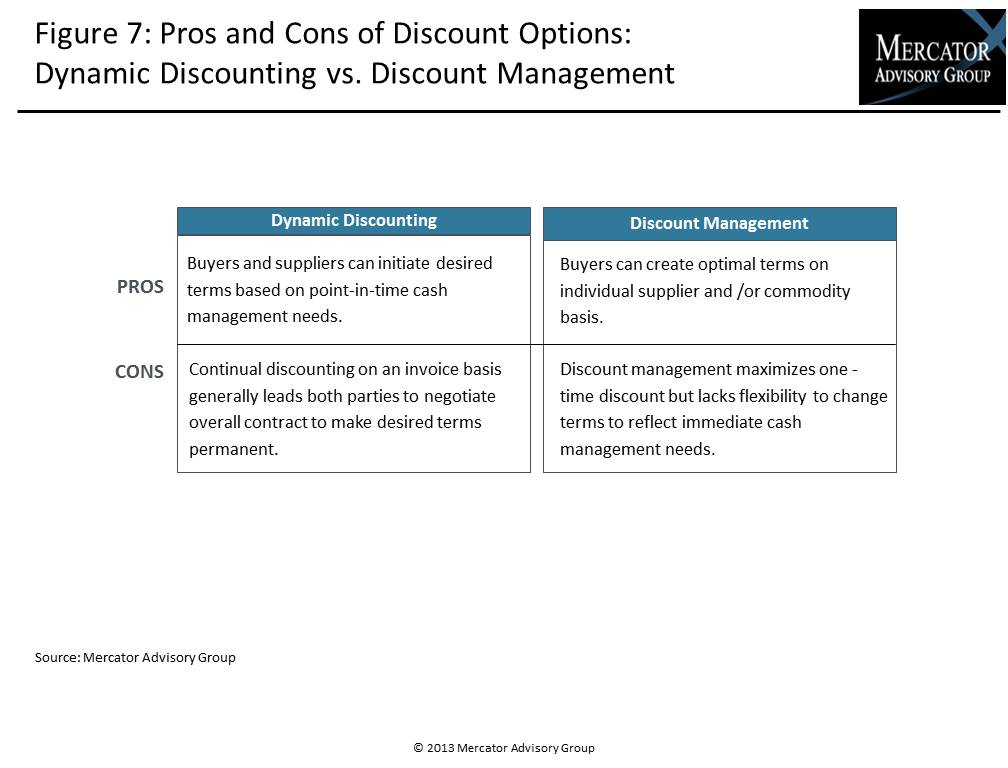

One of the exhibits included in this report:

Highlights of the report include:

- Challenges companies face in making on-time payments

- Evolution of electronic accounts payable (EAP) technology

- Overview of dynamic discounting and supply chain financing (SCF)

- Key solution providers in the marketplace today offering dynamic discounting and SCF

- Recommendations on how to evaluate which solution is right for a buyer organization

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world