Small Business Lending: New Alternatives?

- Date:July 09, 2013

- Author(s):

- Patricia McGinnis

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

One of the exhibits included in this report:

"New lenders are incorporating different data types into their risk assessments and coming up with different answers to would-be borrowers," commented Patricia McGinnis, director of the Commercial and Enterprise Payments Service at Mercator Advisory Group and the author of the report. "While more or newer data cannot transform a genuine bad prospect into a good credit risk, when integrated with new technology and supported by higher rates, it can enable the financing at acceptable risk of businesses that would otherwise be rejected."

Highlights of the report include:

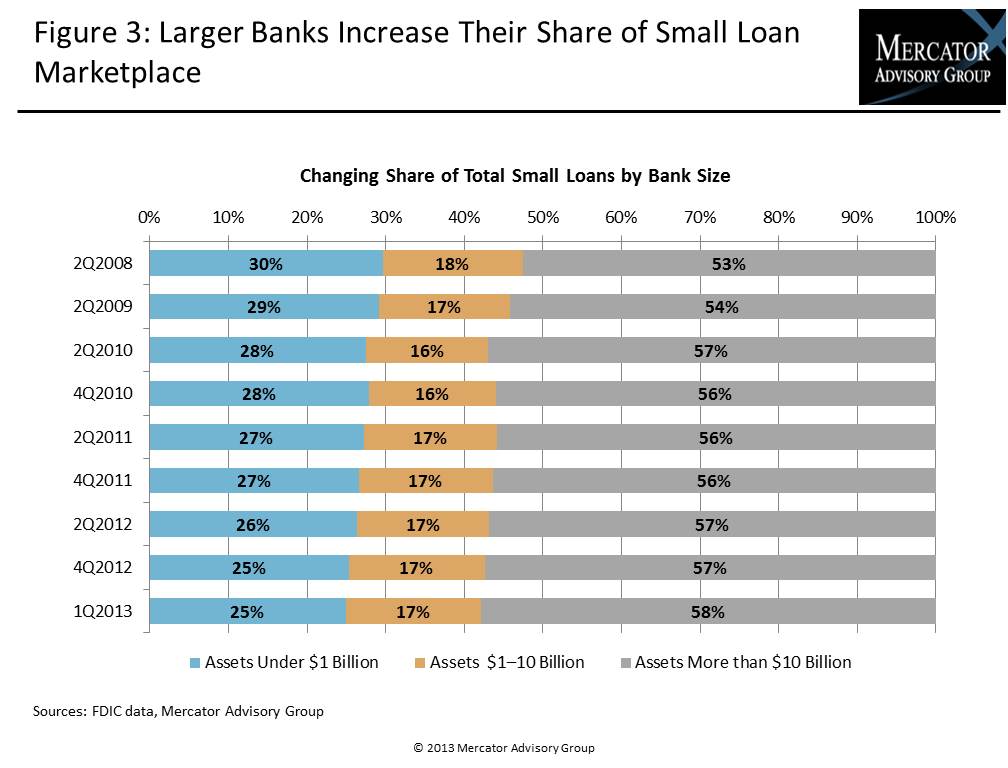

- Assessment of the banks' diminishing role in small business finance

- New entrants in small business finance, both matchmakers and direct lenders

- Introduction to significant vendors providing financing services

- Identification of challenges facing banks in efficiently and innovatively serving small business borrowers

The report is 27 pages long and contains 13 exhibits.

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world