Overview

Boston, MA

December 2008

Small Business Credit Card 2008 Update: Issuers and Customers Seek Order amid Chaos

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report examines recent developments in the highly competitive small business credit card marketplace. Small business credit, charge, and debit purchase volume is approaching an estimated $330 billion annually in the United States, and the market has offered above-average growth for issuers targeting the segment. While the final numbers for 2008 are not in, it has been a challenging year for issuers seeking to maintain control of credit quality, and for small businesses to maintain financial control in the midst of a challenging economic environment.

In the small business credit card segment, 2008 has been a year for issuers to optimize specific abilities they are already good at, such as branch-based relationship products and rewards. But 2008 has also been the year for focusing on small business debit and charge products, as both businesses and issuers strive for financial responsibility (and control).

Highlights from this report include:

- The small business credit card market continued to offer above average growth opportunities to issuers through 2007.

- In spite of the declining economic outlook, small business credit and debit still have room to grow and displace personal payment products and checks in the segment.

- Businesses are moving to reduce their own credit, debit, charge products, plus an array of payments features may come to the aid of all stakeholders.

- With a darkening outlook for business conditions in 2009, issuers best able to create relationships through servicing and/or broader business relationships will be best positioned to grow when conditions improve.

Ken Paterson, Director of the Credit Advisory Service at Mercator Advisory Group and the author of the report comments that, "From our viewpoint in December '08, '09 looks pretty challenging. Yet it is also apparent that if issuers wish to grow in the small business segment, there is still very much room to do so. The real question is whether lenders will have the appetite and ability to continue to grow their portfolios in the next year. Just, as important, issuers best able to retain their clients' loyalty will be best positioned to retain their business when the good times roll again."

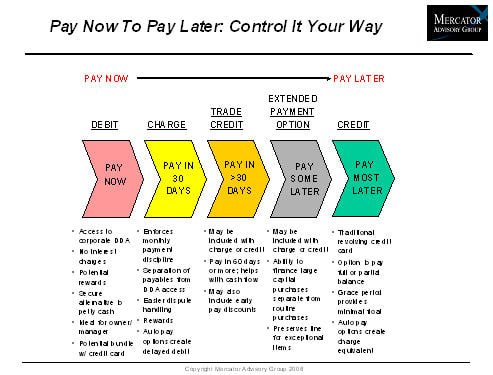

One of the 10 Figures included in this report

This report contains 28 pages and 10 exhibits.

Book a Meeting with the Author

Related content

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Honor All Cards: The U.S. Credit Card Model Takes a Hit

The Honor All Cards principle—that any merchant with a Visa and/or Mastercard sticker in the window accepts all card products on those networks—could be undermined by a recent sett...

Make informed decisions in a digital financial world