Self-Service, ATM, and Other Channel Banking: Rising Use in a Mobile Era

- Date:February 10, 2014

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

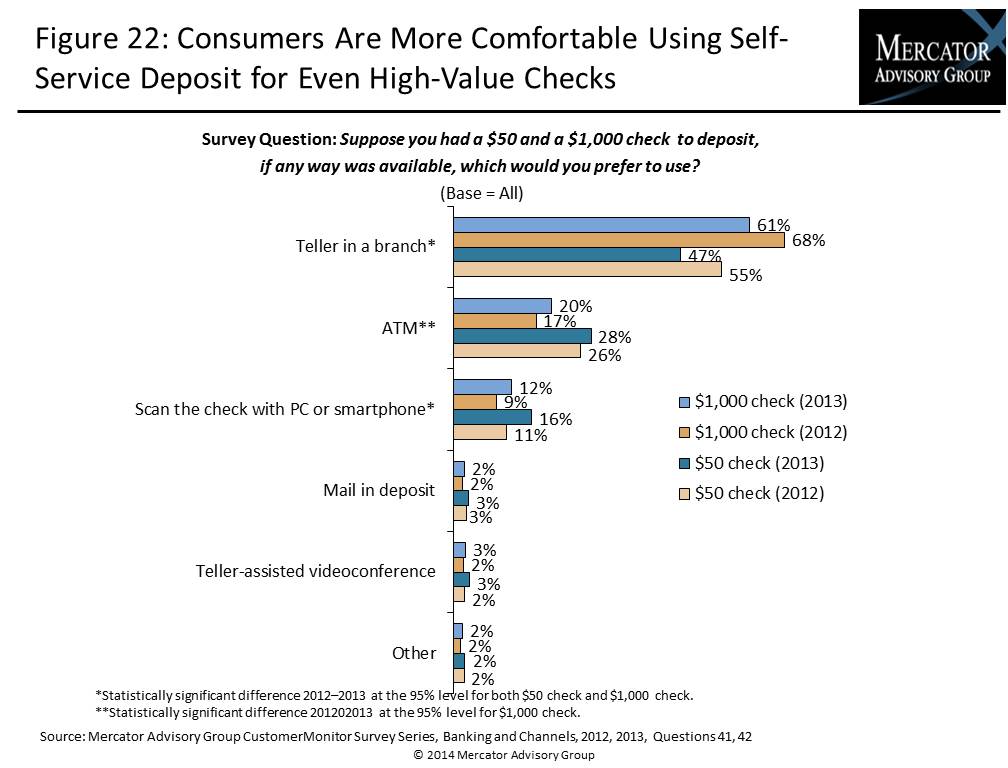

Boston, MA –February 10, 2014 –Mercator Advisory Group’s fifth in a series of eight Insight Reports presenting findings of 2013 CustomerMonitor Survey Series reveals that while more consumers still prefer to use bank tellers to deposit checks, increasing numbers of U.S. adults prefer to use self-service methods for check deposit, primarily ATMs or their own mobile phones or computers. Responses from an expanded sample of 3,001 U.S. adults were collected in the annual online Banking and Channels survey, conducted in November 2013. The survey finds that preference for depositing at ATMs is increasing for both $50 checks. Consumers also increasingly prefer to use their mobile phones and computers to remote deposit capture $50 checks. This is especially true for smartphone and tablet owners, who are just as likely to prefer to deposit via ATMs or remote deposit capture as to prefer to use a teller to deposit $50 checks.

Self-Service, ATM, and Other Channel Banking: Rising Use in a Mobile Era, the latest report from Mercator Advisory Group’s Primary Data Service, highlights consumers’ rising use and interest in a wider variety of self-service and ATM channels, especially consumers who are most technically agile in using smartphones and tablets and mobile banking.

This study examines the demographic shift, changing preferences, and use of self-service channels compared to traditional branch banking and identifies trends in consumer methods of communicating with their bank and frequency of contact, methods, and preferences for getting cash and depositing checks; use of ATMs by type and location; willingness to pay surcharges for convenience; importance of ATM characteristics in new bank selection; interest in using mobile cash access, self-service kiosks, and videoconferencing for discussions with banking specialists and separately for conducting bank transactions.

“The proliferation of mobile channels appears to stimulate ATM and self-service use, not supplant it,” states Karen Augustine, manager of Primary Data Services including the CustomerMonitor Survey Series at Mercator Advisory Group and author of the report.

The report is 66 pages long and contains 28 exhibits

Members of Mercator Advisory Group CustomerMonitor Survey Series Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trending of U.S. adult consumer use of self-service banking channels and frequency of use by each method

- Frequency and use of ATM deposits, envelope vs. no-envelope, cash vs. checks

- Demographics of preferred methods of depositing high- and low-value checks

- Shifts in methods of getting cash and depositing checks

- Importance of ATM features and functionality in new bank selection

- Importance of enhanced functionality, payment services, and coupons and rewards offered at the ATM

- Trends in use of and interest in in-branch videoconferencing with product specialists or teller-assisted videoconferencing for conducting transactions

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world