Overview

The National Automated Clearing House Association (NACHA), the governing body for ACH, has from time to time rolled out new features to broaden ACH’s appeal across channels, most recently faster, same-day transaction processing services. Mercator Advisory Group’s latest research report, Same-Day ACH Debit’s Debut, examines the impact that Same Day ACH (SDA) is having on the payments market.

“ACH, a stalwart among payment types, has again created greater utility by adding a new feature, namely faster transaction processing options. How Same Day ACH fits in among other types of more rapid payment options and how relative market pricing evolves will be critical to users and providers,” commented Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group, author of the report.

This report has 13 pages and 3 exhibits.

One of the exhibits included in this report:

- A review the initial results of the launch of same-day credits, rolled out last year

- Discussion of the most common use cases that have emerged from the introduction of SDA credits

- Prediction of the likely uses of ACH debits, made available on September 15, 2017

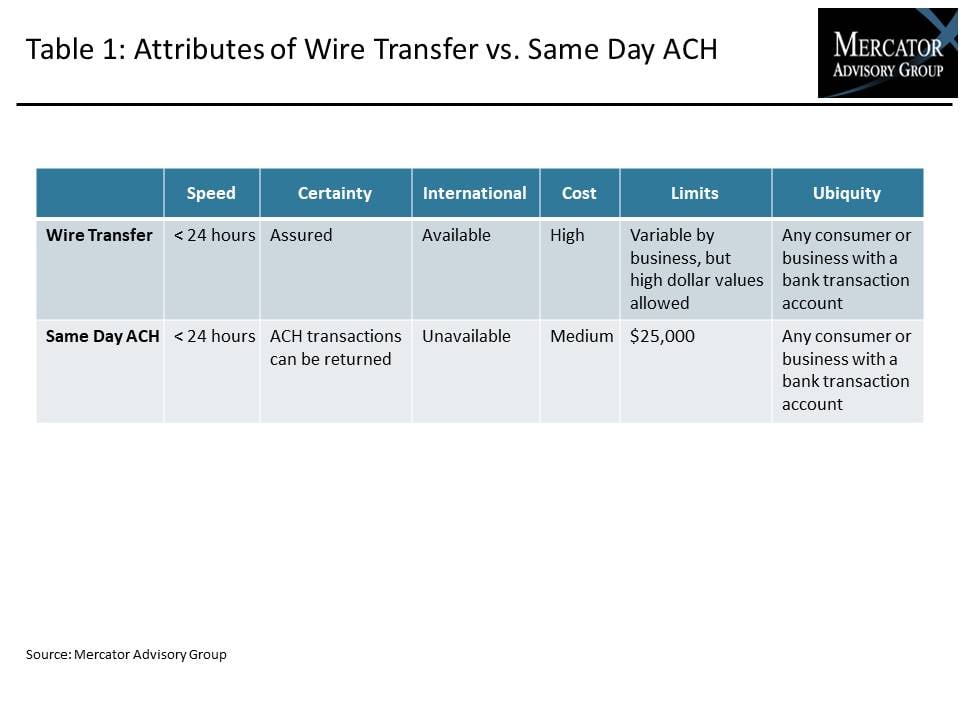

- Analysis of the impact SDA may have on other legacy payment methods, including wire transfers

- Consideration of the fraud concerns inherent with SDA

- Conclusions regarding SDA’s impact on real-time payment initiatives

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world