Overview

August 2008

Boston, MA

REMOTE DEPOSIT CAPTURE SUPPLIER REVIEW

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

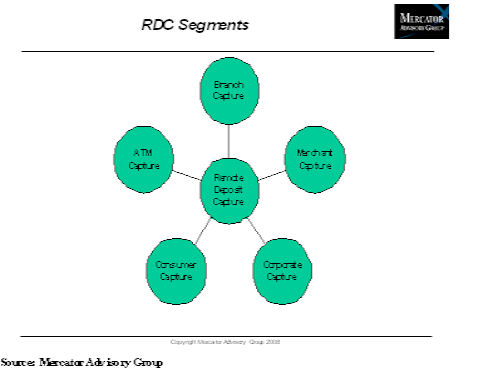

This report provides a primer on Remote Deposit Capture (RDC). It reviews the state of the industry, the impact of RDC on check processing trends, and provides an overview for 10 RDC service suppliers.

This report finds that Remote Deposit Capture continues to experience growing pains even as it has been seriously evaluated by a majority of financial institutions in the United States. RDC already accounts for approximately 13.5 billion items processed on an annualized basis and as a result, Mercator Advisory Group estimates that 44% of all check volume is now cleared through imaging. This means that the check processing tipping point, when the number of imaged checks exceeds the number of paper checks, is approaching very fast.

When selecting an RDC supplier, Mercator Advisory Group finds that it is critical the financial institution (FI) know exactly which target market it will focus on, since suppliers have created RDC solutions that are very target specific. Requirements for RDC services range from the very basic to the fairly complex, from retail stores to corporate venues to bank branches. While each processing requirement has at least one vendor that can satisfy its needs, selecting the most sophisticated solution with an expectation that it can address all market needs would be a mistake. RDC market suppliers have created a jargon all their own and Mercator Advisory Group has found that even the same term, used by two different suppliers, may mean totally different things. For instance, the definition of a "thin-client" can very from supplier to supplier.

The incredible pace of consolidation in the financial services industry has already impacted RDC, as witnessed by the broad product portfolio deployed by Certegy/CheckFree/Carreker. Tim Sloane, Director of the Debit Service for Mercator Advisory Group and the author of this report indicates that this consolidation is unlikely to be over; "Financial institutions should select a vendor that fits their current and future requirements, while recognizing that there will almost certainly be continued consolidation in the industry since there are too many small, undifferentiated suppliers in the market. In RDC, as in all payments infrastructures, scale matters and it matters a lot."

Highlights of the report include:

- While still in its infancy, Remote Deposit Capture is being seriously considered by a majority of banks in the United States.

- On an annualized basis, approximately 13.5 billion items, or 44% of all check volume are cleared through imaging. The tipping point of the number of paper checks and the number of imaged checks has almost been reached.

- RDS service requirements range from the basic to the quite complex, mirroring the demands of their originating users. However the requirements of retailers, corporations and banks are met by at least one vendor currently in the marketplace.

- There are too many players in the RDC space with duplicative offerings of commoditized services. Look for extensive consolidation in the space as vendors try to wring efficiencies from their services and generate additional profits by eliminating margin-squeezing competitors.

- With that inevitable consolidation in mind, financial institutions and merchants can only select RDC providers best addressing their current and anticipated future needs knowing that a new, larger and more expensive provider may be in their future.

One of the 8 Exhibits included in this report.

The report is 26 pages long and contains 8 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to: [email protected]

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world