Procure-to-Pay Convergence: Market Review and Vendor Comparison

- Date:September 06, 2018

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

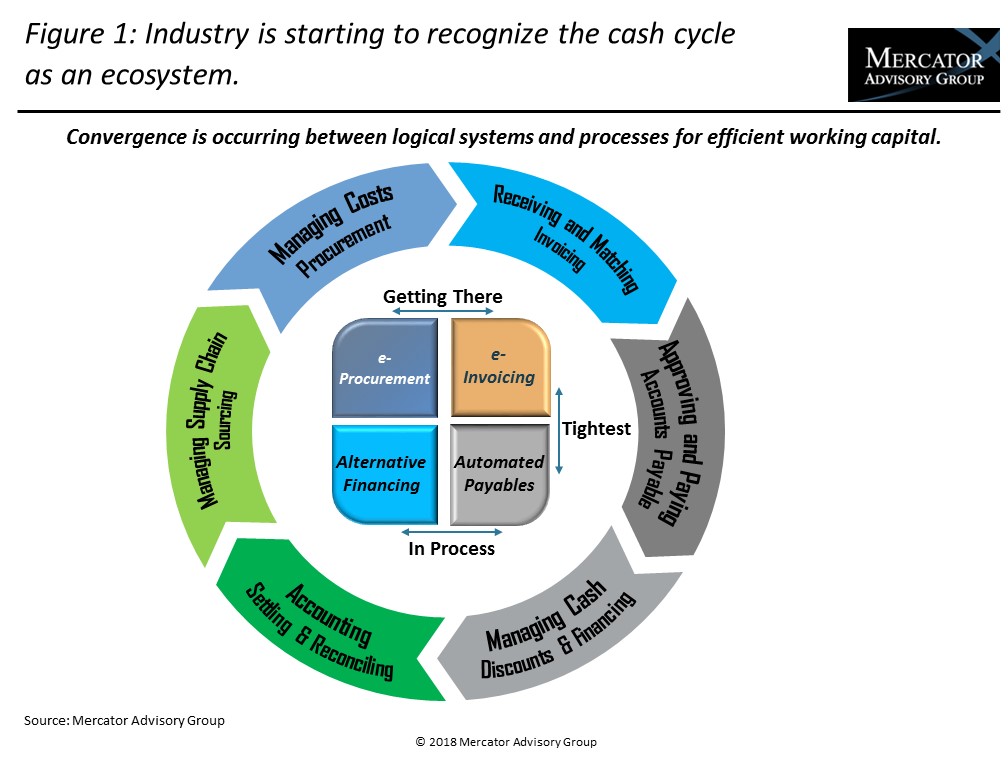

In a new research report, Procure-to-Pay Convergence: Market Review and Vendor Comparison, Mercator Advisory Group examines the trend toward a tighter, more seamless connection between the elements of the corporate cash cycle and evaluates leading vendors offering solutions to accomplish this digital vision.

A growing convergence of systems that support digitization of the cash cycle digitization for companies is occurring as vendors adapt to modern capabilities and increasingly seek to deliver a better experience for the corporate end user. There are myriad back- and front-office systems available to improve financial operations, but in this report Mercator provides an overview of the procure-to-pay landscape and comparison of six vendors that are pursuing the vision of a more complete experience in this market space.

“It is sobering to realize that the modern digital capabilities for supporting business cycle processes began appearing only about 20 years ago. This report is designed to help members understand (and at a high level, evaluate) the systems and selected vendors that provide solutions in the ‘procure-to-pay’ sequence,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service, author of the report. “We include the processes and systems supporting procurement, invoicing, payment, and open account financing. The vendors evaluated in the report have a vision to deliver these services and are at various stages of execution.”

The document is 30 pages long and contains 17 exhibits.

Companies mentioned in this report include: AvidXchange, Basware, Corcentric, Ivalua, SAP Ariba, and Tradeshift.

One of the exhibits included in this report:

- A detailed review of the systemic and process elements that form the procure-to-pay delivery sequence

- A framework for high-level scoring of the key system elements for cash cycle digitization

- A features and functions quick reference chart for comparing vendors

- Vendor profiles and Mercator scoring assessment against the framework

- Case summaries of various product implementations

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world