Prepaid Cards: Continued Growth

- Date:September 18, 2019

- Author(s):

- Peter Reville

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

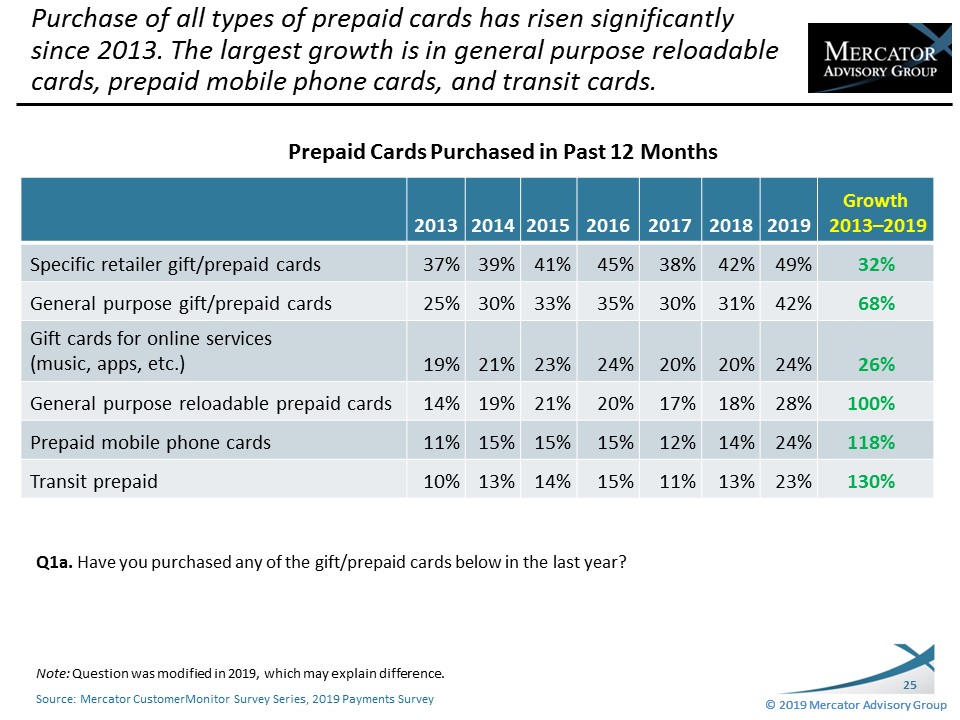

Mercator Advisory Group’s most recent Insight Summary Report, Prepaid Cards: Continued Growth, from the bi-annual CustomerMonitor Survey Series reveals that the growth of transit cards in the United States has been 130% since 2013. Similarly, prepaid phone cards have grown 118% and reloadable general purpose cards have grown 100%. Other types of prepaid cards have also seen impressive growth over this time.

The overall growth of the prepaid cards in the U.S. was 17%, which indicates that consumers who were already buying prepaid cards, are buying more types of prepaid cards.

Like many new products and services, prepaid is a product favored by younger consumers. Currently, about 7 in 10 of those under 45 years of age are buying prepaid cards compared to 5 in 10 of those older than 45.

Prepaid cards are being redeemed online nearly as much as in physical stores. The survey finds that 66% of consumers are redeeming prepaid cards online, which is slightly less than the 73% who are redeeming in-store. Compared to other age cohorts, those 18–34 years of age are more likely to redeem their prepaid cards online (74%) than in-store (64%).

Cash is still king however. When given the choice of gifts, 4 in 10 would prefer cash, while another 13% would like a gift chosen specifically for them and about the same would like a gift card.

Prepaid Cards: Continued Growth, the latest Insight Summary Report from Mercator Advisory Group’s Primary Data Service, is based on a sample of 3,002 U.S. adults surveyed in the annual online Payments survey of Mercator’s CustomerMonitor Survey Series, conducted in June 2019.

The study highlights consumers’ use and interest in prepaid cards and in particular store cards, general purpose (or open-loop) cards and general purpose reloadable cards. The report explores where consumers buy and redeem prepaid cards, whether the cards are purchased for themselves or as gifts, how the cards are used, source of funds for the cards, and other key aspects of prepaid cards in consumers’ lives.

“Americans are finding more and more uses for prepaid cards in their lives as evidenced by the growth of different prepaid card categories revealed by the survey. Prepaid companies need to focus on the different use cases both for buying and funding as well as redeeming to keep up with the evolving use of these cards. The greatest opportunity is likely to come from how these consumers are using prepaid cards for themselves rather than for gifts,” stated the author of the report, Peter Reville, director of Primary Data Services at Mercator Advisory Group, which includes the CustomerMonitor Survey Series.

One of the exhibits included in this report:

Highlights of this report include:

- Type of prepaid cards used and purchased

- Profile of the buyers of the different types of cards

- Prepaid cards for personal use versus gifts and why consumers are buying prepaid cards for personal use

- The types of retail locations Americans buy prepaid cards from and where they redeem them

- Awareness and usage of the prepaid card websites available

- Specific reasons for using closed loop and open loop prepaid cards

- Card spending habits

- Source of funds for reloadable cards

- Reasons for users of reloadable cards to stop using them

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world