Overview

Payroll Cards 100% Electronic Payments 80% of the Time - Crossing the Market Finish Line

New Research Evaluates Best Practices, Trends, and Solution Vendors in Fast Growing Prepaid Segment

Boston, MA -- February 9, 2010 - Payroll cards are one of the fastest growing prepaid card segments and the products are posed for further growth as companies attempt to reduce operational expenses by moving from traditional paper-based payroll systems to electronic distribution methods.

Continuing to gain momentum, with companies like Walmart introducing the cards to employees, payroll cards do face unique challenges from state and federal regulators that need reassurance that the products meet encashment and reporting requirements. Similar to other prepaid products, payroll cards also face heightened sensibilities around the subject of consumer fees for financial services.

Mercator's Advisory Group's Payroll Cards 100% Electronic Payments 80% of the Time Crossing the Market Finish Line report examines the payroll card market and its promise of 100% electronic payroll - an idea whose time may actually have come as solution alliances, regulatory amendments, and consumer readiness may actually be moving the market across the finish line.

"By offering employees the choice between direct deposit into a checking account or on to a payroll card, and carefully explaining the benefits of electronic payment, employers can experience high rates of card penetration (as high as 70% in some cases) or even eliminate paper checks altogether when program participation is mandated," Patricia Hewitt, director of Mercator Advisory Group's Debit service comments. "While most of the case studies we reviewed were voluntary in their construct, we would anticipate that this will change as the industry settles into a more electronic-friendly regulatory environment."

Highlights of Payroll Cards 100% Electronic Payments 80% of the Time Crossing the Market Finish Line report:

An appendix identifying the 51 payroll card solution providers currently operating in the United States.

Solution providers are rationalizing liability-free programs, which remove one of the final barriers to implementing nationwide payroll card programs.

Persistent employee communication on card usage and benefits is one of the hallmarks of successful payroll card programs.

Human Resource managers should consider the entire range of uses for payroll cards and carefully review their employee base when crafting program features and benefits.

Technology and regulatory changes have converged to create a highly favorable market for prepaid payroll cards.

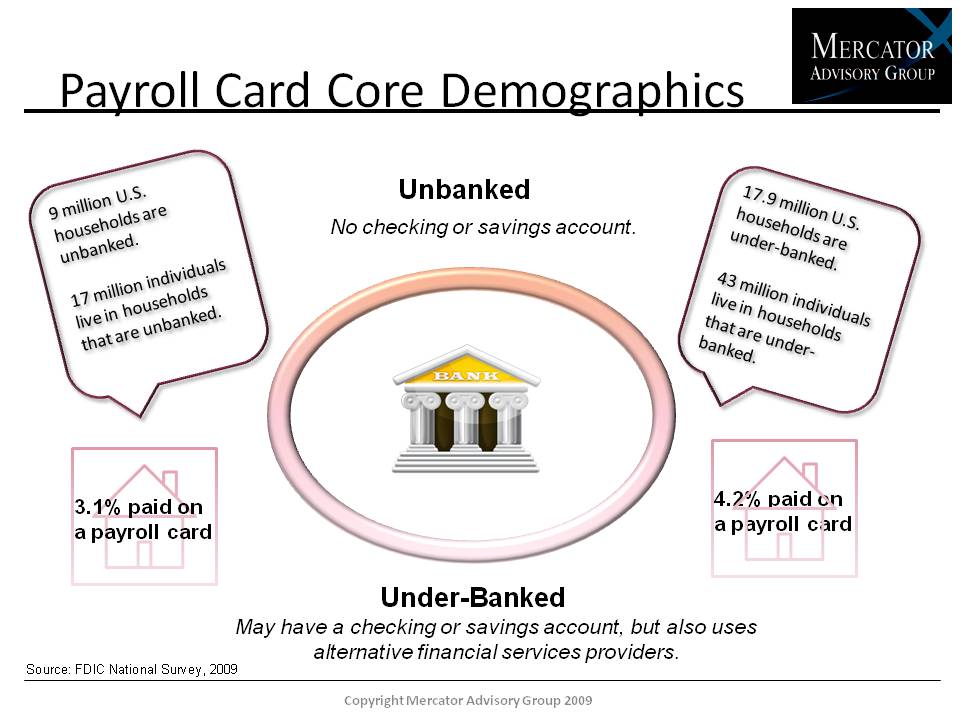

One of 13 exhibits in this report:

This report is 30 pages long and has 13 exhibits.

Companies mentioned in this report include: ADP, First Data, CitiBank, Equifax, Workforce Solutions, Kelly Services, Home Depot, NurseFinders, Steinmart, Toyota, JPMorgan Chase, Walmart, Money Network, Prepaid Services, H & R Block, Intuit, Paylocity, Wells Fargo, Bank of America, MasterCard, Visa, American Express, Discover.

*This list does not include all 53 prepaid payroll card providers mentioned in the appendix.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700 or send E-mail to [email protected]

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world