Overview

Boston, MA

October 2004

Payroll Card Markets & Strategies:

The Market Demands More Than Just a Card

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Employers have discovered that Payroll Cards solve significant problems associated with paying widely dispersed hourly employees, as is common in industries that range from fast food and convenience stores to auto repair chain stores. The employer eliminates the need to create and distribute paper checks and can safely stock Payroll Cards at remote locations since the cards have little value or fraud potential until activated. Employees have discovered that the Payroll Card is similar to a debit card associated with a checking account; but without the need to balance a checkbook or pay monthly checking fees. Cash-centric employees can get the cash from banks, ATMs and other pre-arranged sources.

While Payroll Cards have traditionally been identified as a product for the unbanked, the benefits described above have greatly expanded the market opportunity for Payroll Cards. The Federal Reserve Board indicates that there are 10.3 million unbanked households, but this report has identified 35.4 million potential Payroll Card employees in six unique categories. This pushes the total addressable load-value opportunity for Payroll Cards (excluding benefits and incentives) to approximately $208 billion in 2004.

While these benefits create significant motivation to adopt Payroll Cards the lack of common marketing and self policing by the industry has created significant barriers to adoption. Payroll Cards operate in a complex environment and can be deployed with thousands of different configurations. Not surprisingly, so many options confuse potential employers and can enable complex and/or hidden fee structures (the report identifies 31 unique issues that must be negotiated and 21 potential fees that must be addressed when selecting a Payroll Card supplier).

Unfortunately, these are not just potential problems, bad apples have had a negative impact on the Payroll Card industry and have created a surge in legislation designed to protect employees. Examples of what these legislative activities are trying to eliminate can be easily found on the web where marketing collateral implies free ATM and POS usage while long and complex contracts identifying terms & conditions that show just the opposite is true. Some even charge consumers for a balance inquiry and to dispute charges. Complicating the identification of these rogue solutions is the fact that many of the offerings sport the most trusted names in card brands.

Tim Sloane, Director of the Debit Service for Mercator Advisory Group and the author of the report, expects pending legislation will improve market conditions for the vast majority of Payroll Card suppliers while banks are left to decide how best to participate: "Pending legislation will guarantee fair disclosure, provide a framework for disputes, and provide FDIC protection of consumer assets -- guarantees that are already provided by the vast majority of reputable Payroll Card solution providers. While FDIC protection will assure a role for banks, the vast majority of banks don't yet understand that payroll involves significantly more than a paycheck or a plastic card. Banks that fail to understand the relationship between pay, payroll, benefits, incentives and Human Resources will be poorly positioned to develop appropriate products or implement an effective distribution strategy."

One of Four Exhibits Included in this Report

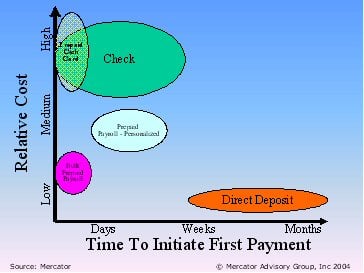

The report "Payroll Card Markets & Strategies: The Market Demands More than Just a Card" guides employers in the selection process, predicts how the markets will expand, identifies the market requirements by market segment, and reports on pending legislation and state laws that prohibit deployment of Payroll Cards through omission. The report is 32 pages and contains 4 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

2026 Prepaid Payments Trends

Prepaid card programs motor along while innovation bubbles beneath the service. In the coming year and beyond, Javelin sees three major themes playing out in the space. First, the ...

Make informed decisions in a digital financial world