Payments Hub Market and Vendor Solutions Overview: Technology Advances Offer a New Perspective

- Date:August 31, 2021

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

Payments Hub Market and Current Vendor Solutions Overview

The original payments hub architectures are roughly 15-20 years old and not necessarily relevant in the new age of technology. The latest generation architecture allows for a new set of requirements, in particular open application programming interfaces (APIs), which need to interface with older systems without requiring major rewrites. The new generation of payments hubs are aimed at facilitating communication and integration with a wide variety of products and services. A new research report from Mercator Advisory Group, Payments Hub Market and Vendor Solutions Overview: Technology Advances Offer a New Perspective, reviews nine vendor solutions with respect to key categories and attributes.

Interest in the payments hub space has grown during the past several years as new technology has become available that provides flexibility to manage a hub in different ways, migrating away from the predominantly bank-hosted deployments of the past. The new era reflects the increase in cloud delivery capabilities and as-a-service models that have appeal to broader asset classes of financial institutions lacking the capital expenditure resources to install and manage payments hub infrastructure. We chose an array of vendors who have solutions that continue to move in this direction, in order to better understand this new generation of hub capabilities.

“There are new instant payments rails, a transition to global messaging standards, and alternative payment types facilitating cross-border transactions,” commented Steve Murphy, Director of the Commercial and Enterprise Advisory Service at Mercator Advisory Group, the author of this report. “So now is a good time for financial institutions to assess their hub capabilities, and in cases where a bank doesn’t have one, determine if now is the time to adopt a hub approach.”

This report is 16 pages long and has 13 exhibits.

Companies Mentioned in this Report: ACI Worldwide, Bottomline Technologies, IBM, Finastra, FIS, Fiserv, Modo Payments, Temenos, Volante Technologies

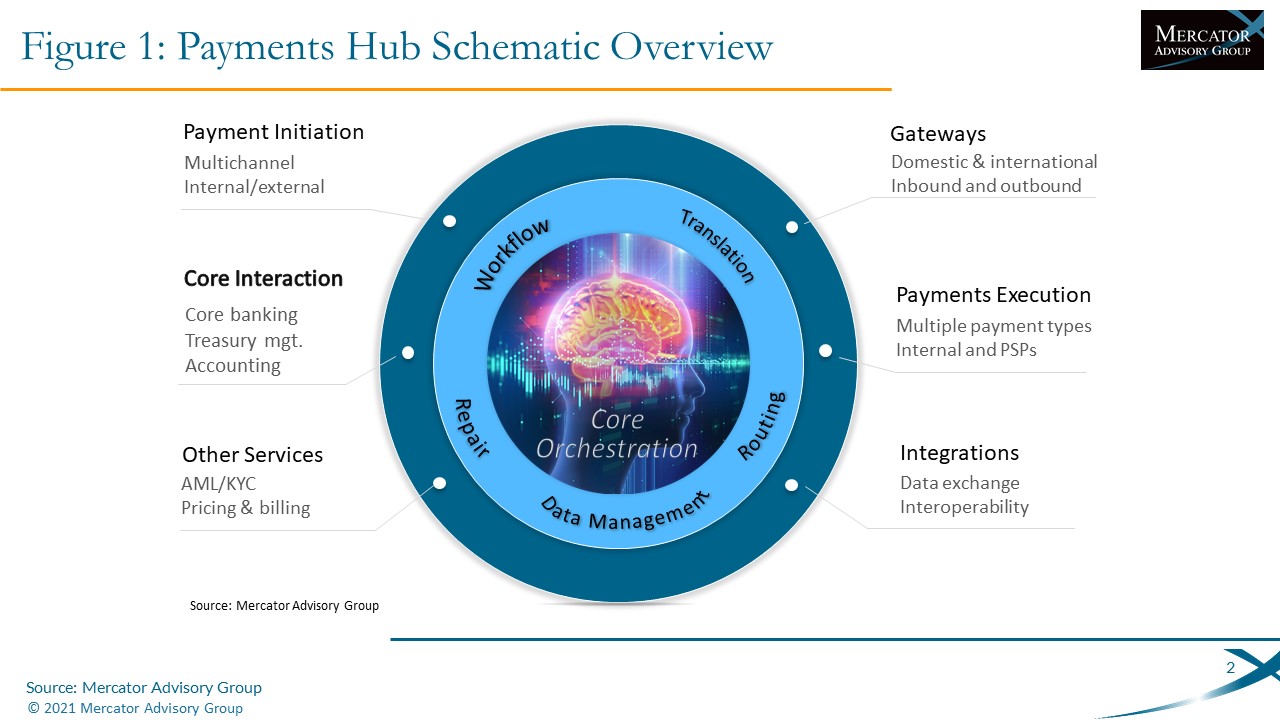

One of the exhibits included in this report:

Highlights of this research report include:

- A detailed framework to evaluate key categories and attributes associated with a payments hub.

- Vendor profiles and nine separate hub solution summaries.

- A summary comparison of all vendor solutions by key category.

- Recommendations for which vendors may suite particular bank delivery needs.

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world