Online Banking: Improving the Customer Experience

- Date:May 07, 2013

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

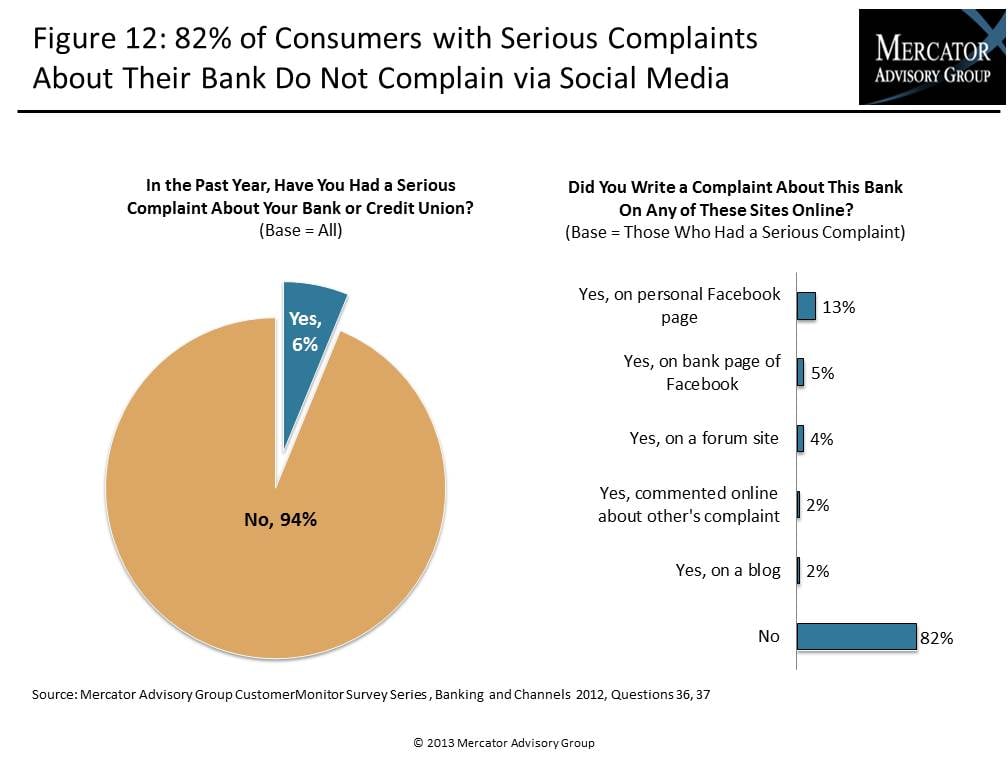

Despite widespread usage of online banking, consumers often hesitate to use an FI's online channels (such as customer service or online chat) but continue to communicate via branch visits or call centers. And, while only 6% of surveyed consumers reported serious complaints about their banks within the past year, three times that number posted complaints on social media websites instead of a bank-sponsored social media site.

Online Banking: Improving the Customer Experience, the latest report from Mercator Advisory Group, is the seventh of eight consumer survey reports based on late 2012 data. This research examines consumer trends in online banking adoption including electronic bill pay, e-billing, and financial management services online. The study also addresses communication channels and satisfaction with online channels, the use of alerts and importance of real-time data and interest in new online technologies.

The report findings are based Mercator's CustomerMonitor Survey Series. The foundation of the series is data obtained during a national sample of 1,008 online consumer survey responses completed between October 23 and November 2, 2012.

"While online and mobile banking enables consumers to choose when, how and where they bank, consumers often do not consider existing online channels the best way to resolve issues or to communicate with their bank. Financial institutions need to improve user experience with online banking by supporting more consistent user experiences among channels and new technologies that offer access to more knowledgeable specialists that can resolve problems online," stated Karen Augustine, manager of CustomerMonitor Survey Series at Mercator Advisory Group and the author of the report.

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trending of mobile Internet access, and the online and mobile banking activities performed by U.S households

- Usage breakdown of electronic payments, e-billing and financial management tools, tax preparation and personal financial management programs

- Shifts in communication methods and satisfaction Importance of real-time access by type of banking and payment activities

- Trends in videoconferencing usage and interest

The report is 37 pages long and contains 14 exhibits

Members of Mercator Advisory Group CustomerMonitor Survey Series Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world