Overview

Boston, MA

September 2005

Network & Bank Rules Hamper Adoption of Biller-Direct Recurring Payments

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Mercator Advisory Group research indicates that adoption of the biller-direct recurring payment model by consumers is hampered by systemic problems in the payment networks originally designed to support single purchases. These systemic payment network problems exist in three areas: 1) the rules that govern the payment networks (and merchant compliance); 2) the interaction of these rules and consumer needs relative to Regulation E; and, 3) bank procedures that control consumer bank accounts and manage disputes.

The fundamental consumer difference with recurring payment transactions involve the considerable time period that many of these relationships span. As a result, there needs to be significant flexibility to address changes (both upgrades and non-performance/dispute resolution issues) relating to these payments as they occur. Today, there are rules that hamper consumer adoption by placing a significant burden on both consumers and merchants seeking to engage in recurring payment transactions.

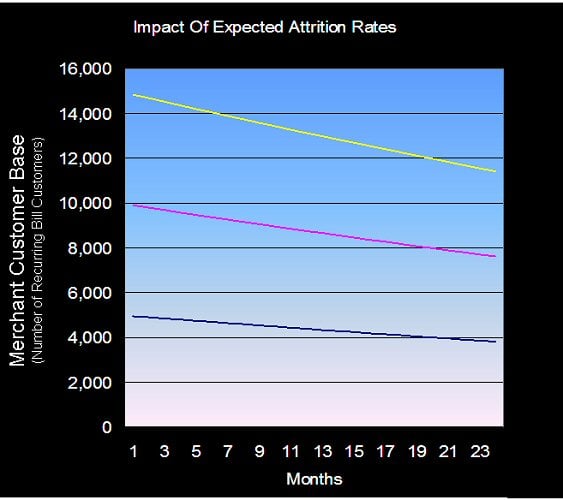

The result of these systemic problems is higher than necessary attrition rates, likely approaching 12% annually for selected recurring payment types, and reluctance by consumers who have been impacted by these problems to re-enroll in any other biller-direct program.

The impact of these problems is extremely significant for companies that implement direct-biller programs and to banks that receive the debits these programs issue because the consumers that are most likely to run into these systemic problems are the high transactors (those technically savvy high disposable income consumers that most frequently utilize online banking and perform online spending). This high transactor segment is highly coveted by both banks and merchants.

One of many contributors to the high attrition rates is the lack of control a consumer has over the imposition of fees when their bank account has insufficient funds. While much has been written on bank fees lately, this research indicates that the mechanism by which banks impose fees can actually hamper the bank's initiatives to increase transaction volumes through building recurring payment relationships, particularly if the transaction volume is tied to biller-direct recurring billing programs.

This problem can also be viewed as an opportunity for billers and banks to differentiate themselves. "Merchants can design their systems and procedures to overcome the problems that are fundamental with the payment network and bank based dispute process. By implementing their own user-friendly dispute process billers can re-position themselves as trusted suppliers to on-line savvy consumers," noted Tim Sloane, Director of Mercator Advisory Group's Debit Advisory Practice. "In addition, merchants should avoid any justification for a recurring bill payment initiative that assumes significant savings in postage and mailings. Instead, merchants should carefully consider how to perform target marketing to participants of the recurring bill payment program that will maximize the lifetime of those customers."

A sample exhibit from the report

The report contains 29 pages and 2 Exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world