Mobile and Tablet Banking: P2P Is Driving Growth

- Date:April 15, 2015

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group’s Insight Report from the bi-annual CustomerMonitor Survey Series reveals that as usage of mobile banking rises in the United States, more consumers are switching their primary financial institutions. Young adults and mobile banking users are most likely to switch, in part to gain more robust mobile banking services.

Now, 3 in 5 U.S. consumers perform banking activities using their mobile phone and/or tablet, up from nearly half who did so in 2013 and one-third who did so in 2012. Mobile banking via smartphone or tablet is growing rapidly, fast becoming a way that many bank customers and credit union members prefer to conduct their banking activities for its convenience and “on the go” accessibility. Mobile-based money transfer to another person’s account is one of the fastest growing mobile banking activities, doubling in usage in the U.S. from 2013 to 2014. In 2014, half of young adults surveyed used their mobile phones to transfer money to another person’s account and 22% of young adults used their mobile to transfer funds to accounts outside the U.S.

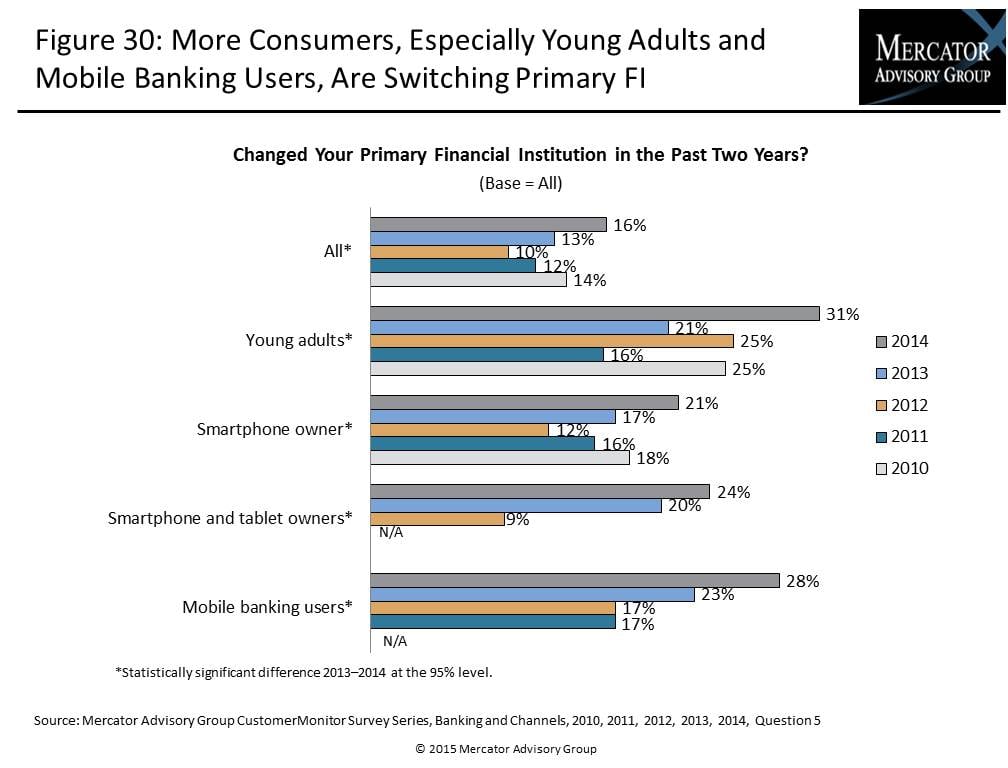

Mobile banking users, however, and young adults, who are the most likely to be using mobile banking, are switching financial institutions more than ever as they reevaluate their banking institutions’ offerings. Young adults, because of the transient nature of their life stage, have always been more likely to switch financial institutions, but over the past two years, young adults have reported switching far more than usual. In fact, 31% of young adults and 28% of mobile banking users surveyed in 2014 reported they switched their financial institutions over the past two years, a notable increase from approximately 20% who reported doing so in our 2013 survey. Young adults and mobile banking users are now nearly twice as likely as the average U.S. consumer (16%) to have switched. With the rise in mobile banking, consumers apparently are increasingly reevaluating their financial institutions’ banking offerings and more have decided to change FI.

Mobile and Tablet Banking: P2P Is Driving Growth, the report from Mercator Advisory Group’s Primary Data Service, is based on a survey of 3,000 U.S. adults conducted online in November 2014, as part of an annual Banking and Channels survey. The study highlights consumers’ rising use of mobile phones and tablets for banking and the demographics of mobile users and those engaged in mobile banking; consumer confidence in the security and reliability of mobile phones for banking; methods, preference, and frequency of communication with financial institutions; banking activities performed by smartphone, tablet, or computer; and mobile banking’s impact on branch visitation and consumers’ view of mobile app functionality.

“Mobile banking by mobile phone and tablet banking is rising rapidly, especially among young adults, and becoming a preferred banking method among the broadening array of options available to banking customers in the United States. More consumers, however, are reevaluating their financial institutions, especially young adults and mobile banking users, who are more likely to open new accounts and switch their primary financial institutions. Improving the usability and functionality of mobile banking will continue to be vital for customer retention,” states Karen Augustine, manager of Primary Data Services including the CustomerMonitor Survey Series at Mercator Advisory Group and author of the report.

The report is 68 pages long and contains 31 exhibits

Members of Mercator Advisory Group CustomerMonitor Survey Series Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

One of the exhibits included in this report:

Highlights of this report include:

- Trending of mobile Internet access using different access methods

- Mobile banking activities and methods, and demographics of mobile device and mobile banking users in the United States

- Shifts in U.S. consumers’ methods of communicating with their financial institutions; frequency of communication and preferred methods

- Shifts in consumers’ preferred platforms for making bank transactions

- Trends in banking activities performed by U.S. consumers by device type and demographic segment

- Challenges to mobile banking adoption, and ratings of mobile device security and reliability

- Importance of real-time access to funds by type of banking activity

- Impact of mobile banking on frequency of branch visits

- Trends in consumer perception of security and reliability of mobile phones for use in making bank transactions

- Year-over-year trends in consumers who switch primary financial institutions

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world