Overview

Boston, MA

October 2005

PAYMENTS INDUSTRY M&A REPORT - Q3 2005

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

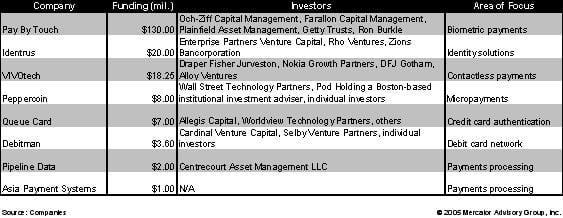

There were 28 M&A deals, 2 IPO's, and 8 financing deals (Table) announced this quarter. The largest deal was the $4.5 billion merger of Fidelity National Financial and Certegy. The breakdown of these deals is as follows:

* Credit Card Issuers - 6 deals

* Processors and acquirers - 6 deals

* Check Cashing Vendors - 1 deal

* Vendors - 15 deals

"In addition to continued M&A activity, there was Venture Capital activity this quarter. Numerous technology companies secured Venture Capital and Private Equity Investment. This trend will lead to additional acquisition activity, drive innovation, and enable market expansion for emerging technology companies in the payments industry", comments Evren Bayri, a Director in Mercator Advisory Group's Credit Advisory Service and author of this report.

The Payments Industry M&A Report - Q3 2005 provides comments and analysis on major deals announced within the third quarter of 2005, summary information on the payments industry related M&A deals, contact person(s) related to each deal, and an M&A activity table that summarizes the highlights of each deal.

The report contains 55 pages and 6 Exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Make informed decisions in a digital financial world