Overview

The “internet of things,” shaped from advancements in technology, has resulted in an exponential rate of devices (things) connecting to the internet. This expansion of connections and data collection enables more processing powered by artificial intelligence to augment our daily decisions and abilities. Both consumers and merchants are capitalizing on this technology, with the strategic applications changing the way consumers and merchants transact.

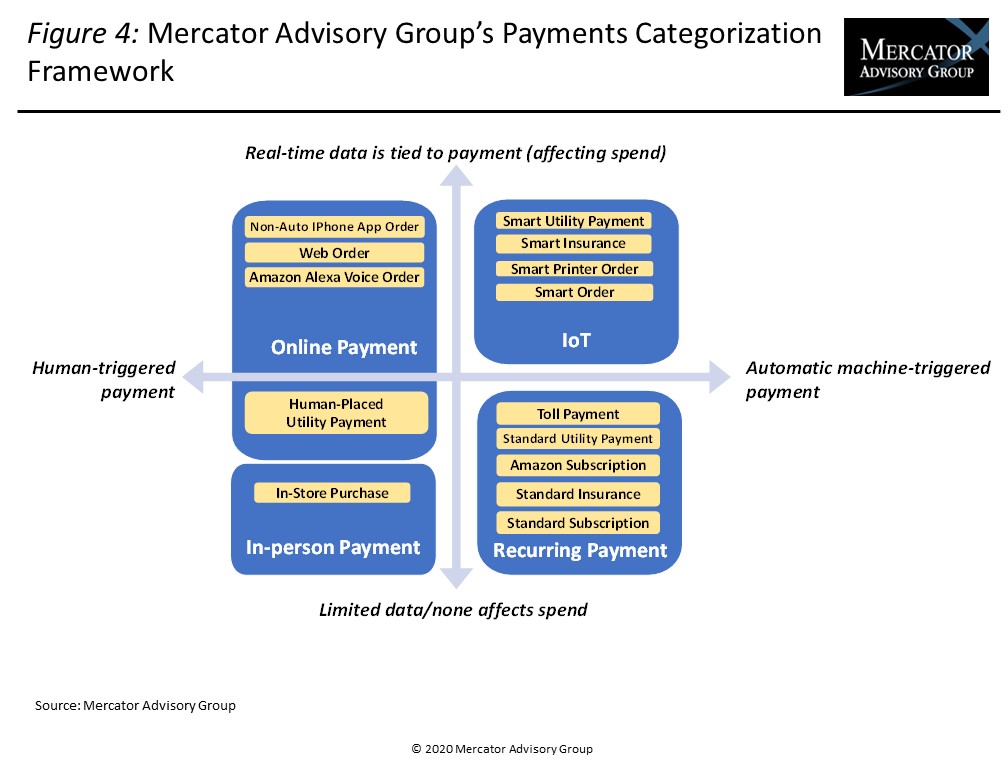

Mercator Advisory Group’s latest research report, IoT Payments: How the Internet of Things Is Influencing Payments, provides a foundational framework for categorizing payments by bridging payments and technology to define and analyze four basic payment modes: in-person, online, recurring, and IoT payments.

“Consumers and merchants are rapidly adopting technology and utilizing the IoT, further digitizing their relationship. Prior to Mercator Advisory Group’s research on the topic, there was no concrete definition of the concept “IoT payment,” and thus it was impossible to analyze this complex market segment. In constructing a payments categorization framework that bridges technology and payments, it became clear to Mercator Advisory Group that payments are becoming increasingly online and recurring and moving in the automated data-driven direction of the internet of things, comments David Nelyubin, Research Analyst, Emerging Technologies at Mercator Advisory Group and author of the report.

This report has 21 pages and 8 exhibits.

Companies and other organizations mentioned in this report include: Amazon, Apple, Canon, Domino's Pizza, Epson, HP, Intel, Microsoft, MIT, Netflix, Papa John’s, Procter & Gamble, Progressive, U.S. Department of Commerce, U.S. Department of Energy, U.S. Energy Information Administration, Wall Street Journal, Walmart, and Whole Foods.

One of the exhibits included in this report:

Highlights of the report include:

- Discussion of the movement of consumers and merchants toward internet of things (IoT) connected payments

- Analysis of payment modes and infrastructure, separating IoT devices from IoT payments

- Analysis of a basic purchase process and presentation of a new model, the Mercator Payments Categorization Framework.

- Definitions of the four payment modes or categories: in-person, online, recurring, and IoT payments)

- Discussion of infrastructure, agents, full process map of an IoT transaction, and a comparison of the different payment modes.

- Current market segments segmented by the four payment modes — in-person, online, recurring and IoT — with a focus on IoT payments.

- Discussion of trends and future implications of IoT payments and the agents that are affected.

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world