Overview

Boston, MA

May 2008

India's Electronic Payments Future

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

India boasts one of the fastest growing economies in the world. The Indian banking and payments sector have undergone reforms and are rapidly changing. The Reserve Bank of India (RBI) has made modernizing the improving efficiency in the country's payment system a top priority. As such, India's central bank has set up essential payments infrastructure and implemented regulatory policies that promote the migration to electronic-payments systems. Private and foreign banks are also playing an increasingly important role in India's banking sector, which has been historically dominated by state-owned, traditionally paper-based banks. As competition intensifies in India's banking and payments industry, there will certainly be enormous opportunity for growth and intensive product innovation, as financial industries compete for new and richer consumer segments.

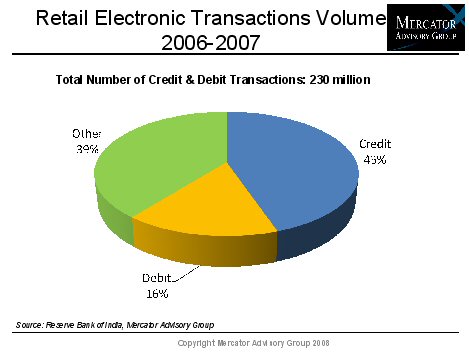

Although India remains a predominantly cash and paper based society for financial transactions, the number of payment cards in circulation, both credit and debit, has been increasing sizably in the last five years. Evidence of the growth in payment cards is also reflected in an increase in number of automated teller machine (ATM) and point-of-sale (POS) terminals across the country. India's telecommunications sector has also registered exponential growth in mobile subscribers in the last few years. As such, many financial institutions and mobile service providers are partnering to offer more robust and available mobile payments solutions. Payment products leveraging mobile technology have the potential to allow large numbers of consumers to gain access to the formal banking system, particularly Indian consumers in rural areas, who have not been able to date.

The report contains 28 pages and 10 exhibits

"Although cash continues to be a dominant mode of payment in India, more Indian consumers are changing their spending habits to include more electronic payment product options. Indian consumers tend to use their credit cards for purchases and their debit cards more for cash withdrawals at ATMs," notes Elisa Athonvarangkul, Analyst Mercator International Advisory Service. "India's populations is young, upwardly mobile, and its middle class is undoubtedly on the rise. As Indian consumers become more familiar with payment cards and the benefits they offer, they will choose to leave paper currency and check books behind and will prefer not to leave home without their credit/debit cards."

The most recent report from Mercator's International Advisory Service provides an overview of India's payments market. The report also presents a review of India's banking industry and payments sector, an analysis of recent trends in the country's payment card market, as well as a discussion of product offerings, reward programs, and mobile payments.

Other recent research from the International Advisory Service:

| The Evolving Landscape for Prepaid Cards in Latin America and Europe | |

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world