Improving Cash Cycle Management Is a Key to Corporate Stability

- Date:February 11, 2021

- Research Topic(s):

- Commercial & Enterprise

- Debit

- PAID CONTENT

Overview

Improving cash cycle management is a key to corporate stability.

Companies of all shapes and sizes should be continuously seeking to attain financial operations efficiency, minimize resources consumed by manual processes, and gain better control over the management of working capital through automation. The pandemic has proved to be a wake-up call for companies lagging in the execution of this vision. A new research report from Mercator Advisory Group, Improving Cash Cycle Management Is a Key to Corporate Stability reviews the current situation and trend forward for processes and solutions used across financial operations.

Overall global economic contraction was 3.5% in 2020. Although 2021 and 2022 GDP projections are a relatively strong 5.5% and 4.2% respectively, recovery strength will vary significantly by country, with less developed markets particularly vulnerable. The level of technology investment and automation initiatives increased during 2020, and represent a likely ongoing trend in 2021. This will be important as revenues will be generally harder to come by into 2022 as economies attempt to regain lost ground.

“Banks and other technology solution providers should be seeking to capitalize on these critical financial process needs by providing capabilities that require fewer client company resources to launch and support,” commented Steve Murphy, Director of the Commercial and Enterprise Advisory Service at Mercator Advisory Group, the author of this report. “This will help drive loyalty and provide stronger foundational client bases.”

This report is 14 pages long and has 6 exhibits.

Companies and other organizations mentioned in this report include: Association for Financial Professionals, AvidXchange, Basware, Billentis, Bill.com, Bottomline Technologies, Corcentric, Coupa, GEP, International Monetary Fund, Ivalua, Jaggear, Mineral Tree, Nvoicepay, SAP Ariba, Tipalti, Tradeshift

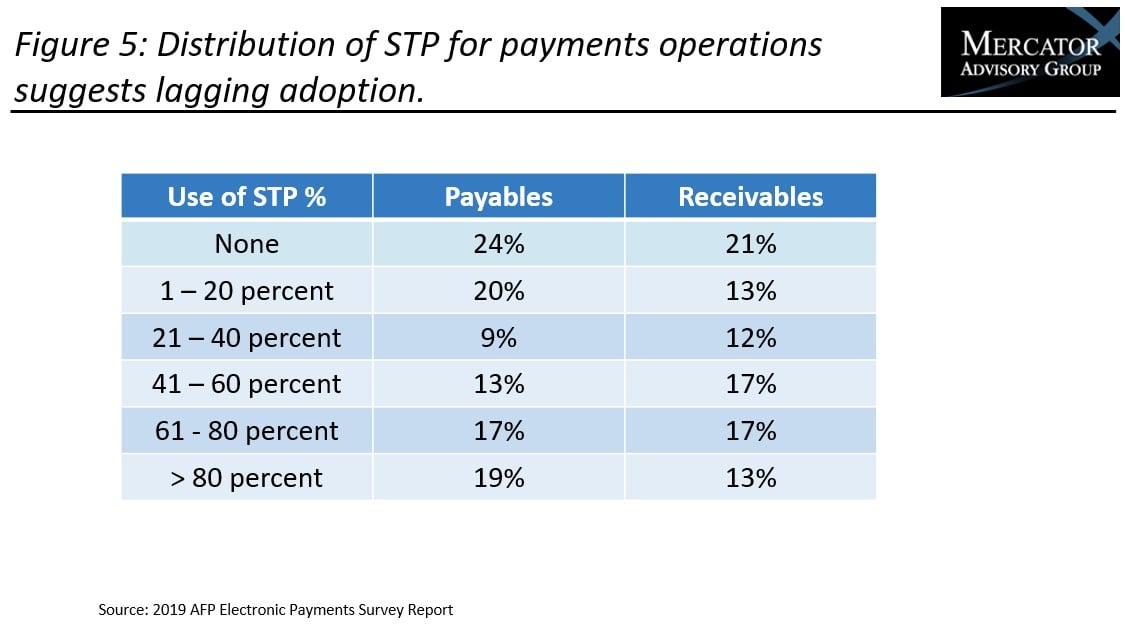

One of the exhibits included in this report:

Highlights of this research report include:

- Post-pandemic economic outlook in global markets by region

- Review of how cash cycle management impacts costs and working capital

- Detailed analysis of cash flow opportunities generated by strong financial operations

- Review of the technology approaches across the cash cycle and unfolding trends

- Case analysis of specific technology benefits

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world