Overview

Boston, MA

June 2007

HSA Growth Accelerates In Uncharted Waters

A Look at the Marketplace and the Applications of Prepaid Debit Cards to HSA

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Significant investments are being made today to implement Prepaid HSA cards that will provide significant benefits to cardholders and Third Party Administrators (TPAs). The most important of these is the inventory information approval system (IIAS) that will deliver auto-adjudication, significantly reducing administration costs for TPAs while eliminating the need to submit and file records by the cardholder.

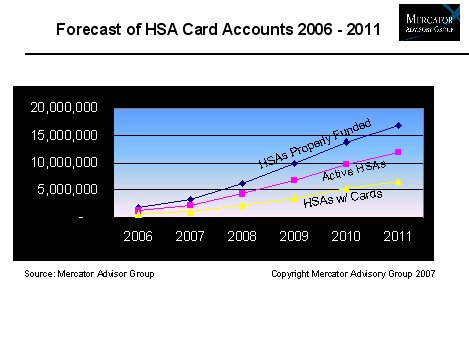

This report evaluates the size of the HSA market today and forecasts growth through 2011. It also offers a forecast of the number of HSAs that will likely be candidates for HSA Prepaid cards. Not all Health Spending Accounts will be candidates for a Prepaid HSA card. For instance, many HSAs are under funded. Many have very low transaction rates because the owner perceives the HSA more as an investment account than for health spending. Both of these consumer behaviors will reduce deployment of Prepaid HSA cards.

"It is not just account holder behavior that will delay adoption of Prepaid HSA cards", states Tim Sloane, Director of the Debit Service at Mercator Advisory Group. "The broad acceptance of the inventory information approval system is also critical to the value proposition these cards deliver to TPAs. Every time a transaction is not adjudicated it reduces the cost savings the HSA depends on and frustrates the cardholder. It will be years before IIAS works for services rendered at hospitals or doctor's offices - and these account for 51.7% of all healthcare related expenditures according to the AMA."

Highlights of the report include:

- It is very likely that financial asset management firms will spend heavily to advertise the benefits of the HSA as an investment instrument, directly competing with banks for these account dollars.

- It is possible that the next presidential campaign will again focus on healthcare and that a new administration will legislate an entirely new environment ??? making all existing forecasts obsolete.

- While there are just over 1 million HSA accounts associated with a Prepaid HSA card today, this will increase to 6.5 million accounts in 2011 ??? a compound annual growth rate of just under 60 percent.

- Broad deployment of IIAS is an important assumption that is built into this forecast. Any additional delays or balkanization of the market into competing systems would significantly lower the forecast.

One of the 13 Exhibits in this report:

This exhibit shows the number of properly funded HSA accounts that will be opened between 2006 and 2011. It also shows the predicted number of HSAs that will have prepaid HSA cards associated with them.

This report is 35 pages long and contains 13 exhibits, and tables.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world