Overview

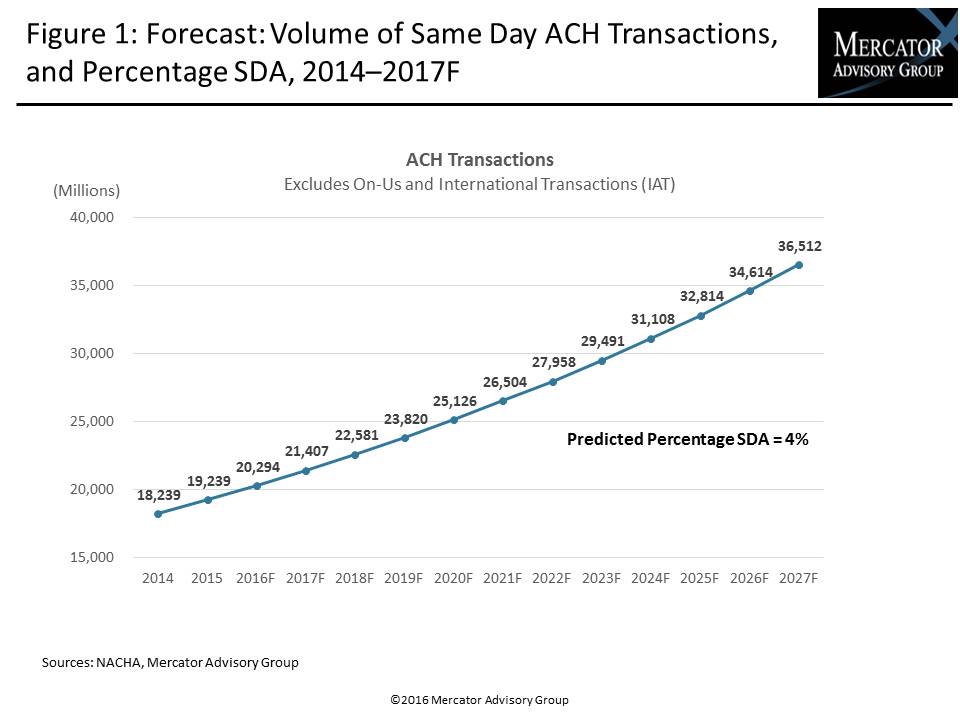

Mercator Advisory Group’s latest research note, Here Comes Same Day ACH, looks at how same day ACH is being introduced, its potential impact to the payments market, and issues that financial institutions are grappling with as they get ready to incorporate same day ACH into their sales and operations environments.

“Same Day ACH (SDA) may not be revolutionary in its technology, but making same day ACH widely available will impact new products that will use same-day to facilitate transactions. SDA has the potential to uproot or change the course of faster payments initiatives. Same Day ACH does not have all the attributes of a faster payment as defined by the Federal Reserve, but it may be fast enough for some payment scenarios, taking away potential business from still developing faster payments initiatives. Near ubiquity and a low price point make Same Day ACH very attractive,” comments Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and author of the research note.

This report has 12 pages and 2 exhibits.

Companies mentioned in this document include: Bank of America, clearXchange, FIS, Fiserv, MasterCard, NICE Actimize, PayPal, U.S. Bank, Visa, and Wells Fargo.

One of the exhibits included in this report:

- Details of the national Same Day ACH roll-out plan

- How Same Day ACH compares with faster payments initiatives

- The impact on financial institutions

- Probable use cases where Same Day ACH will thrive

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world