Overview

Research Provides Guidance for Developing

International Prepaid Card Processing Strategy

Going Global: Taking Prepaid Processing Abroad

Boston, MA -- As US prepaid card processors look for new business they may find attractive opportunities await them outside the US as numerous prepaid products and applications are being planned, piloted, and introduced in different countries to meet local needs.

Mercator Advisory Group's new report, Going Global: Taking Prepaid Processing Abroad provides guidelines that allow issuers, program managers and processors to develop an outline of key issues that must be addressed when planning to process prepaid cards in a foreign country.

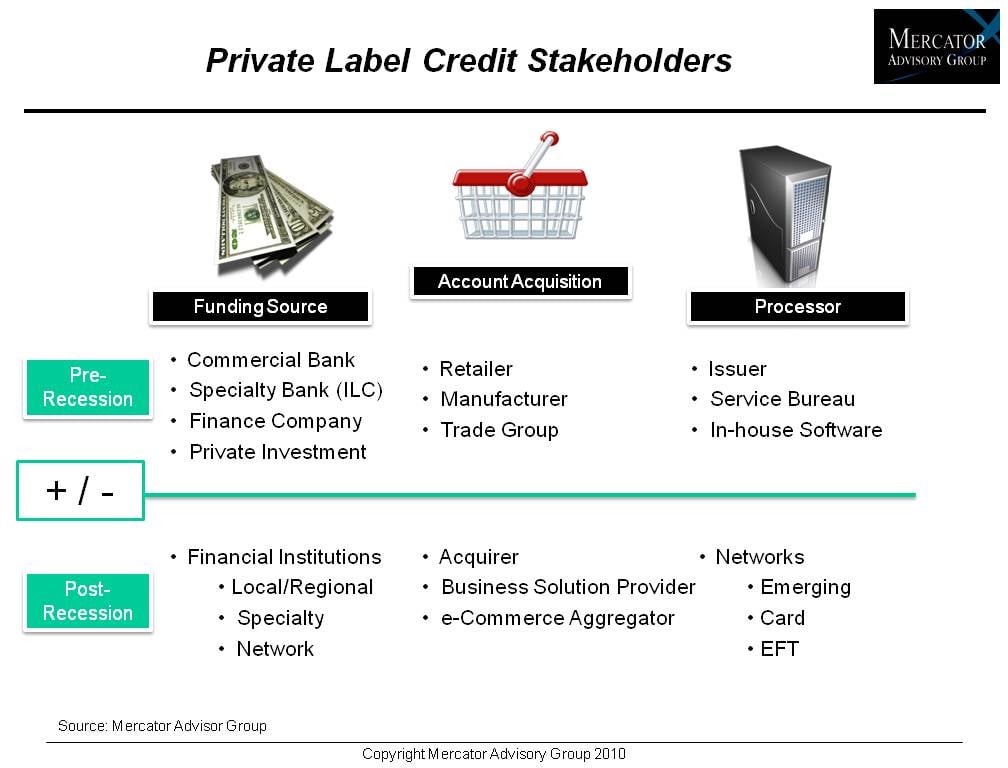

The report describes a connectivity map in the US and explains how that map may differ in other countries. This report compares the prepaid card value chains in the US and abroad and the implications of those differences. Also discussed are costs associated with going into new countries, platform readiness, infrastructure, contractual arrangements and regulatory issues to consider.

Processors that have deep expertise in one or two segments in the U.S. and are beginning to consider offshore opportunities must exhibit the most caution in country selection to make sure alignment is achieved with both prepaid card market readiness in general as well as in their specific prepaid market segment.

Highlights of the Going Global: Taking Prepaid Processing Abroad include:

As the U.S. prepaid business has matured, processors are looking abroad to find new business that can leverage their platform and expertise, but it would be a mistake to underestimate the challenges associated with prepaid processing in other countries.

Selecting a new country demands a layered process that begins with creating a short list based on each country's ability to support prepaid in general, and then moves to an evaluation of the processors own strengths. In-country segment research and ultimately a feet-in-the-street analysis complete a structured evaluation process that is detailed in this report.

Processors need to look for where they can add value to a payments provider, which may be in nontraditional roles, because many prepaid card sponsors act as processors and program managers.

This report identifies a detailed list of the key processes and external networks and service providers that must be evaluated when moving a prepaid platform to a new country or when processing for local issuers remotely.

Because of the wide variation in payments systems from country to country, prepaid processors cannot assume that entering one country is the key to an entire continent or region.

"Given that there are so many variations from country to country -- and even within countries when it comes to things like network interfaces, ATM drivers, settlement mechanisms, and regulations -- it is easy to see that each country must be approached as a separate entity. This also demonstrates why one country cannot be relied upon to serve as an entryway into another. Even though there are affinities and crossovers between some nations, the internal variations in each country mean that each country will present new challenges to processors," Ben Jackson, Sr. Analyst with the Prepaid Advisory Service and author of the report comments. "However, if a processor's margin and volumes can be sustained by the business in the new country after it has evaluated the cost of addressing all of the issues discovered during these assessments, adapted its internal infrastructure, and formed the necessary connections and partnerships, then it is prepared to go global."

One of six images in this report.

This report is 28 pages long and contains 6 exhibits

Companies mentioned include: MasterCard, Visa, Discover, American Express, Network for Electronic Transfers (Singapore) Pte. Ltd., M-PESA, Shazam, Pulse, NYCE, First Data, STAR, ADP Inc., India Card, Itz Cash Card Ltd., Novo Payments.

Members of Mercator Advisory Group have access to reports as well as research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700 or send E-mail to [email protected]

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments industry. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Related content

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

2026 Prepaid Payments Trends

Prepaid card programs motor along while innovation bubbles beneath the service. In the coming year and beyond, Javelin sees three major themes playing out in the space. First, the ...

Make informed decisions in a digital financial world