Global Interchange Regulation: Pandora’s Box for Commercial Cards?

- Date:August 20, 2015

- Author(s):

- Richard Hall

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

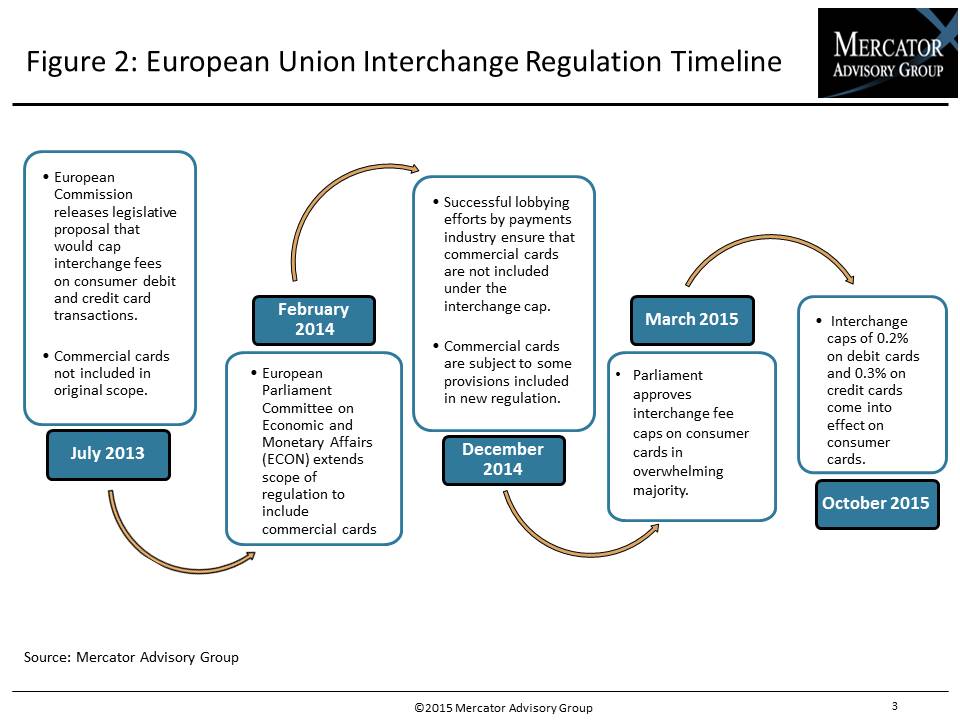

Since the enactment of the Durbin Amendment in the U.S. with its caps on interchange (multilateral interchange fees) on consumer debit and credit card transactions, a topic of discussion has been the potential expansion of similar limits to commercial cards (also known as corporate or business cards). Recent regulatory activities in markets outside of the United States, particularly in the European Union, have caused many in the commercial card issuing industry to assess what caps would mean for their business.

Mercator Advisory Group's research note, Global Interchange Regulation: Pandora’s Box for Commercial Cards?, examines the current state of commercial card interchange based on global regulatory activities and learnings from the regulations enacted for consumer credit cards.

"Regulatory activities in the European Union in late 2014 concerning payment cards were interesting to observe with regard to the potential inclusion of commercial cards in broader interchange cap discussions,” comments Richard Hall, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and coauthor of the report. “The U.S. commercial cards issuing market has quietly watched for clues as to whether the subject of capping interchange for commercial cards will reemerge in the coming years since the potential impacts on issuers’ revenues could be significant.”

The research note is 10 pages long and contains 3 exhibits.

Members of Mercator Advisory Group's Commercial and Enterprise Payments Advisory Service and Global Payments Advisory Service have access to this document as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

One of the exhibits included in this report:

Highlights of the research note include:

- The contribution of interchange in commercial card issuers’ revenues

- Interchange regulation in the European Union and other global markets

- The potential impacts of interchange regulation on commercial cards

Book a Meeting with the Author

Related content

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Capabilities in Context: A Value Chain Analysis of AP and AR Providers

Payment providers looking for integration and partnership opportunities with accounts payable and accounts receivable vendors are well-advised to assess potential synergies based o...

From Volume to Value: Balanced Scorecards for Commercial Payments

Success in commercial payments is no longer just about growing volume; it’s about proving value. This Javelin Strategy & Research report shows how a balanced-scorecard approach can...

Make informed decisions in a digital financial world