Overview

Most studies find that merchants spend at least five times more to gain a new customer than to keep an existing one. Further, higher customer retention typically leads to greater business profits. A new research report from Mercator Advisory Group, Gamification and Other Strategies for Merchants to Enhance Customer Loyalty, assesses different types of customer loyalty programs across various retail verticals and discusses key success factors for merchants to act upon.

“Getting shoppers to keep coming back is critical for both brick-and-mortar stores and e-commerce in the retail world. Consumers can choose among a variety of competing brands, and engaging loyalty programs are often a differentiating factor encouraging continued patronage,” commented Raymond Pucci, Director of Merchant Services at Mercator Advisory Group, author of this report.

This report is 19 pages long and has 6 exhibits.

Companies mentioned in this report: 7-Eleven, Alliance Data Systems, Amazon.com, AMC Theatres, American Airlines, Apple, Bahama Breeze, BJ’s Wholesale Club, Bloomingdale’s, JPMorgan Chase, Citgo, Citibank, Costco, Cumberland Farms, Darden, Delta Airlines, Discover, Domino’s Pizza, Dunkin’, Excentus, Exxon Mobil, Facebook, Fandango, FIS, GasBuddy, Google, Loblaw, LongHorn Steakhouse, Lowe’s, Lyft, Macy’s, Marriott, Mastercard, Nordstrom, McDonald’s, Olive Garden, Panera Bread, Punchh, Regal, Rite Aid, Sam’s Club, Samsung, Seasons 52, Shell, Shopify, Smile, Southwest Airlines, Stamp Me, Starbucks, Synchrony, Target, Twitter, Uber, United Airlines, Visa, Whole Foods, Yard House, ZipLine

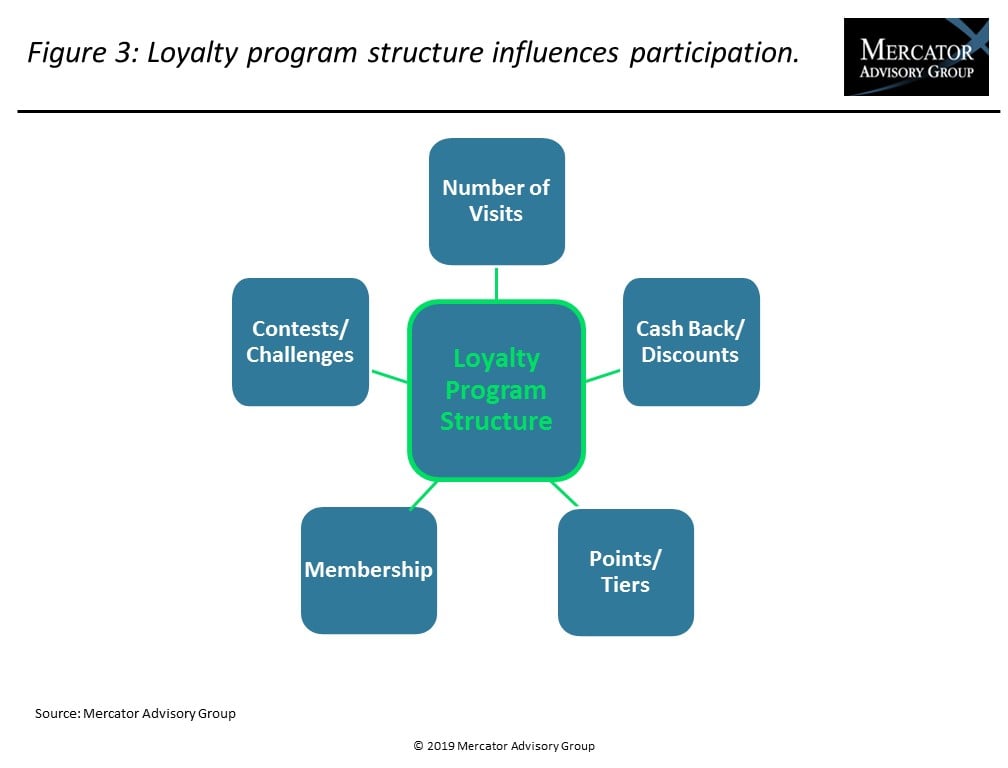

One of the exhibits included in this report:

Highlights of this research report include:

- How loyalty program structure influences customer loyalty

- Integrated features that increase loyalty programs’ success

- Gamification methods that drive customer engagement

- Vertical markets that have highest customer participation in loyalty programs

- The role that mobile apps play in keeping consumers’ attention

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world