Overview

Boston, MA – February 6, 2014 – Boston, MA – In new research, Extending the Reach of Channels to Include Wealth Management and Small Business Banking, Mercator Advisory Group reviews the trend at banks, credit unions, and other financial institutions to leverage two of their most profitable lines of business—wealth management and small business banking—to expand customer and member relationships.

“Extending banks’ and credit unions’ reach beyond consumer demand deposit accounts (DDA) to new accounts in other lines of business deepens customer relationships and opens up new revenue opportunities based on deepened relationships with both retail banking customers and small business owners,” comments Ed O’Brien, director of Mercator Advisory Group’s Banking Channels Advisory Service and author of the report.

This report is 23 pages long and has 13 exhibits.

Companies mentioned in this report include Bank of America, BBVA Compass, JPMorgan Chase, Citi, Citizens Bank, Equifax, Middlesex Savings Bank, Phoenix Global Wealth Monitor, Reliance Bank, Santander, and TD Bank.

Members of Mercator Advisory Group Banking Channels Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

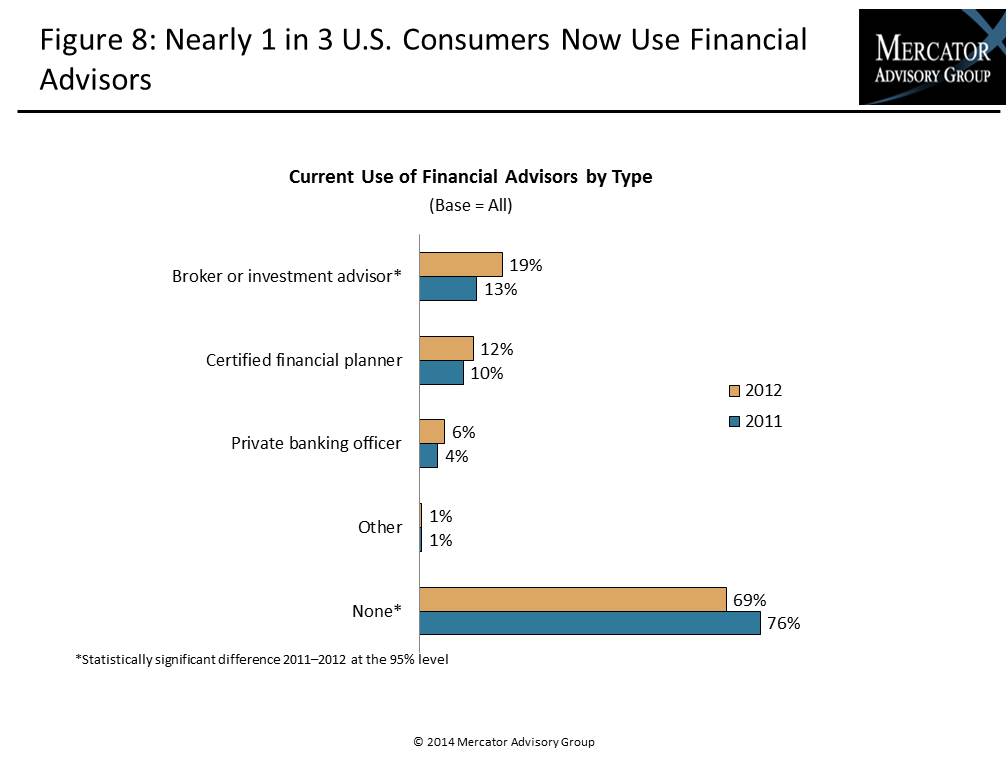

One of the exhibits included in this report:

Highlights of this report include:

- Ways for today’s banks and other financial institutions to broaden their product portfolios, increase loyalty, and expand and deepen relationships

- Potential of financial institutions’ two most profitable lines of business—wealth management and small business banking

- Ways for FIs to attract wealth management business from different income segments

- U.S. user profiles for banking products and services

- Examples of wealth management outreach strategies followed by leading banks

- Examples of small business banking strategies

Book a Meeting with the Author

Make informed decisions in a digital financial world