Overview

RESEARCH IDENTIFES NEW BANKING STRATEGIES TO WIN ASSETS OF EMERGING AFFLUENTS

Emerging Affluent Households: Uncertainty Creates

New Opportunities or Bank Advisors

As the economy enters its second year in an official recession, Emerging Affluent, like all Americans, are affected by home foreclosures reaching an all-time high, the economy shedding 2.6 million jobs in 2008 and home values continuing their precipitous declines. Even if Emerging Affluent are guardedly optimistic about continuing in their own jobs, their retirement portfolios have been hammered in a stock market performing at Great Depression levels.

A new report from Mercator Advisory Group's Retail Banking Practice Emerging Affluent Households:Uncertainty Creates New Opportunities for Bank Advisors offers an in depth examination of the challenges and opportunities found in targeting Emerging Affluent households. With incomes of more than $100,000 and/or investable assets between $100,000 and $1 million (more than 24 million households), this consumer segment is being underserved by banks, while enthusiastically being served by brokers.

It is Mercator Advisory Group's position that banks can win the investable assets of these households, but they must leverage their technologies to lower incremental transactional servicing costs; reexamine their own wealth management compensation structures that push brokers to focus exclusively on the Truly Affluent; and they must seek out new products and new marketing messages to successfully obtain customers who have felt rebuffed by banks in the past.

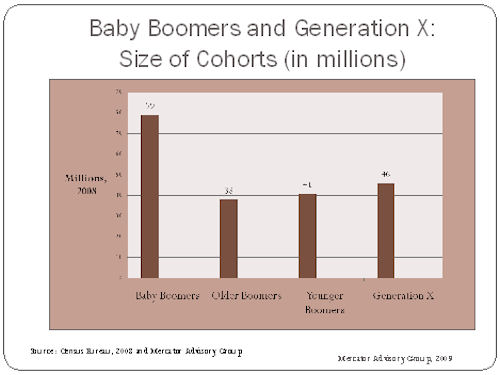

"While everyone in financial services (be they banks, brokerages, financial planners, wealth advisors, mutual fund providers or insurance companies) has been hungry for the assets and debts of the truly affluent, it has been difficult for banks to leverage their human capital resources and technology budgets to target, service and profit from the Emerging Affluent," comments Elizabeth Rowe, Group Director of Mercator Advisory Group's Banking Advisory Services and author of the report. "The banking community continues to be significantly challenged in marketing to the Emerging Affluent's two key and quite large demographic cohorts: Younger Baby Boomers and Generation X."

For institutions willing to try new strategies, Rowe states that the Emerging Affluent can be pried from their brokerage relationships and brought into the bank with: savings-focused credit cards, Certificates of Deposit Account Registry Service, low-fee annuities and continually updated news on Federal and state tax programs.

Report Highlights Include:

- This is a critically important time/opportunity for banks/credit unions marketing to the Emerging Affluent. The segment has been hammered by the disappearing act played by their 401(k) s and their declining home values. They need help now.

- In 2009 and 2010, $400 billion will shift from consumer spending to savings. Banks must promote innovative core deposit products that are attractive to Emerging Affluent customers new to actively saving.

- New payment instruments combine the new inclination to save with the old inclination to accrue rewards. The Fidelity Retirement Rewards AmEx card and the Schwab Bank Invest First Visa credit card both offer 2% cash back with that bonus going directly into investments/savings.

- Many Emerging Affluent households will benefit from initiatives in the Federal government's new stimulus package. As details of these programs are known, banks/credit unions need to actively outline and explain how these will affect their customers.

- Technology investments bring the power of one-to-few communications to the Emerging Affluent and also help banks sidestep some of their internal silo issues. While client ownership must belong to a bank officer or branch or product line, the ancillary turf wars erupting over services rendered and value-added can be avoided.

One of the 17 Exhibits included in this report:

Baby Boomers and Generation X: Size of Cohorts (in Millions),

Companies Mentioned in This Report:

American Express, Bank of America, Charles Schwab, Fidelity Investments, HSBC, Merrill Lynch, Promontory Interfinancial Network, Regions Bank, T. Rowe Price, Visa, Wells Fargo

This report contains 35 pages and 16 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.Mercator Advisory Group.

For more information and media inquiries, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments industry. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, and associations to leading technology providers.

-30-

Book a Meeting with the Author

Make informed decisions in a digital financial world