Overview

August 2008

Driving Consumers toward Mobile Money Services: Lessons from South Africa, the Philippines, and Kenya

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

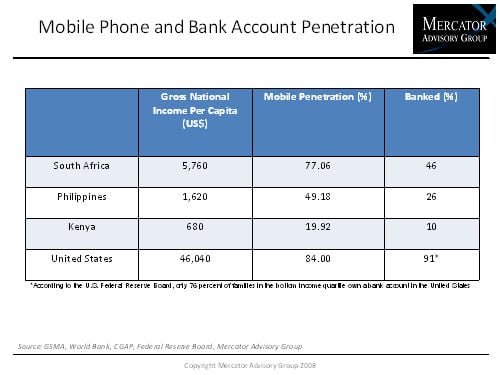

In many developing economies, more citizens own mobile phones than own traditional bank accounts. There are a variety of reasons why a large number of consumers remain unbanked, including affordability and accessibility limitations. However, some financial service providers and mobile operators are leveraging mobile technology to increase access to formal financial services, particularly to low-income and underserved consumers. Such mobile phone-based money services include person-to-person funds transfer, prepaid airtime purchases, prepaid electricity purchases, utility bill payment, remittance transmittal, and other functions. These mobile money services do not require new technology infrastructures or their costs, but can be employed using existing technologies in a new application. For example, in the Philippines and Kenya, short message system (SMS) is used for a variety of financial transactions. SMS can be used in rural areas with limited data coverage, with most account types, prepaid and postpaid, and with most mobile handsets, even low-end and basic models.

One of the 6 Exhibits included in this report

Elisa Athonvarangkul, Analyst in Mercator Advisory Group's International Advisory Service and principal analyst on the report, says, "Customers of mobile money services in developing countries often live on relatively low-incomes, and are highly cost-aware and price-sensitive. They prefer fee structures that charge per-transaction as opposed to bundled services packages because the former charges for exact usage only and gives consumers more control over services usage and their finances. SMS-based mobile money services, in particular, have been highly successful because they are affordable and consumers already have a high comfort level and familiarity with the technology."

The most recent report from Mercator's International Advisory Service and Emerging Technologies Service provides an overview of the current state of mobile money services in select markets and analyzes key issues, such as business models, marketing and pricing strategies, technology, and regulatory environments. The report also provides case studies and an in-depth discussion of select mobile money services, including Wizzit in South Africa, Smart Money and G-Cash in the Philippines, and M-Pesa in Kenya.

This report contains 33 pages and 6 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send an email to mailto:[email protected]

Book a Meeting with the Author

Related content

Building the Bridge to Payments: 3 Investment Trends for 2026 and Beyond

Investment in fintechs’ payment technology in 2026 is being shaped by a strong shift toward “bridging technologies” that connect legacy systems with emerging capabilities. Investor...

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

Make informed decisions in a digital financial world