Overview

October 2007

Decoupled Debit - Let's Take a Closer Look

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report examines the recent emergence of this new and possibly disruptive technology in the financial services industry, decoupled debit. Decoupled debit is an alternative based ACH debit card solution that utilizes two existing systems that are well defined in the financial services industry but were not designed to work in combination with each other, the ACH network and the branded payment networks, such as MasterCard, Visa, NYCE, etc. Intermediate service providers use the "man in the middle" approach to switch the consumer from their bank issued debit card to a debit card issued by the intermediate service provider effectively decoupling the consumer DDA from the FI debit card. The consumer's card transaction is performed and settled online over the branded payment networks between the merchant and the intermediate service provider but is settled with the consumer's FI using the offline ACH network. The "decoupling" of the consumer funding DDA and the traditional FI card issuer allows the intermediate service provider to capture the interchange income from the card transactions which, in the traditional model, would normally go to the FI. A decoupled debit environment is shown graphically in the attached figure.

The decoupling of the card issuance and the account holder does not come without added risk. New risks such as account validation, which have not been inherent in the aforementioned payment systems, must be managed with a whole new approach. The decoupled debit platform also requires a great deal of heavy lifting to implement. But thanks to Tempo Payments, who has recently unbundled their proprietary decoupled debit platform, there may be more players in the market sooner than later.

Patty Hayward, Senior Analyst of the Debit Advisory Service for Mercator Advisory Group and the author of this report recognizes the impact decoupled debit may have in the industry; "The fear of the unknown is palpable in the financial services industry with the uncertainty of how the decoupled debit platform will affect the competitive balance of interchange and consumer loyalty within today's traditional debit card model. There are two options FI's can pursue to protect themselves from this potential disruptive technology."

The report reviews a number of the decoupled debit products that are available in the market today which have traditionally focused on the merchant, reducing interchange costs and enhancing consumer rewards. The decoupled debit concept is not new to this market but has not been widely accepted because of inherent challenges in the system. Consumer adoption and data collection are two key elements to any product's success and has been a difficult problem to overcome in the decoupled debit products to date. Unlike the Pay-by-Touch or Tempo Payments products the Capital One and PayPal MasterCard branded decoupled debit products provide a more consumer-centric approach to the concept with broader merchant acceptance. Plus Capital One adds higher than usual rewards currently offered in the debit card market today to the offering.

Highlights of the report include:

- An examination of the decoupled debit process from transaction origination through settlement.

- How the transaction flow of the traditional debit product differs from the new decoupled model.

- An overview of the advantages and challenges related to decoupled debit.

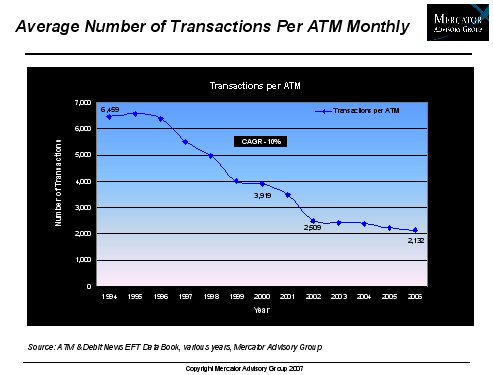

One of the 8 Exhibits in this report:

This report is 29 pages long and contains 7 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world