Overview

Debit Processing in the United States: A Focus on

Issuer Solutions

RESEARCH REVIEWS AND EVALUATES DEBIT CARD PROCESSING SERVICE PROVIDERS:

Financial institutions are seeing a lowering of the value of depository accounts while having to manage profitability in an economy that requires organizations focus on pulling cost out of their operations at an increasing rate. A new report from Mercator Advisory Group's Debit Practice, Debit Processing in the United States: A Focus on Issuer Solutions raises the important question of how are primary service providers in the debit processing industry responding with products and services that are relevant to the main issues facing financial institutions today?

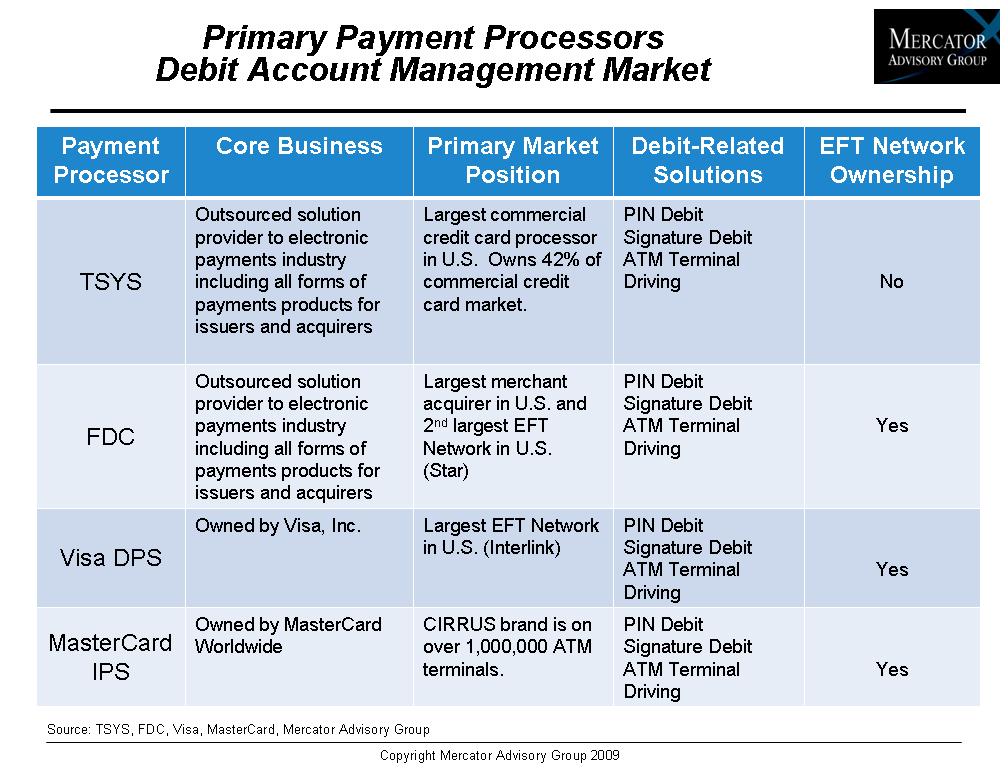

The debit processing industry has three basic components: a card issuer, an account management system and an EFT network. Upon careful analysis of any single element, one finds a myriad of solution providers, all attempting to differentiate themselves in a market whose maturity level makes it increasingly difficult to stand out from the crowd.

This insightful review and discussion on the current traditional debit card processing services industry in the United States, provides a view of the industry from the vantage point of account management systems. Mercator Advisory Group reviews and evaluates the major service providers in this category including EFT networks, payment processing service bureaus, and financial services companies and how they are addressing the needs of the traditional debit card issuer.

It is Mercator Advisory Groups opinion that while many providers in this industry have built debit-processing strategies around EFT acquisitions, functionality gaps have narrowed and creating market differentiators requires a more granular focus than ever before. The ability to integrate meaningful analytics in an accessible manner is becoming increasingly important as issuers look for ways to build deeper account holder relationships that have a more sustainable rate of return.

"As with many other industries born during the beginning of the Information Age, the debit processing industry has reached a maturity level in both its business and technology models and is rapidly moving through its specialization phase. Reaching this developmental stage has occurred for all debit stakeholders, including the EFT networks, processors, and card issuers," comments, Patricia Hewitt, Director of Mercator Advisory Group's Debit Advisory Services. "Each of these industry segments is emerging from a period of consolidation and product investment into a new phase where functionality gaps are quickly closing, making market differentiators more difficult to define."

Report Highlights Include:

1. Traditional debit card transaction activity is continuing to experience double-digit growth; offering rich opportunities for all stakeholders in the market.

2. The functionality gaps between debit issuer processing solution providers is getting narrower. Offering both core DDA processing and debit card processing may have an advantage in certain market segments.

3. Solution providers are differentiating themselves through focused investments tied to leveraging more of their organizations assets across the enterprise and providing broader, deeper access to account analytic data.

4. Non-interest fee income is a critical component of deposit account profitability and financial institutions are actively seeking ways to maximize revenue and extract costs out of their debit card programs.

5. Innovative products based on traditional debit cards have yet to prove their long-term sustainability in the market, but they should be watched.

One of 17 Exhibits included in this report

Companies Mentioned in This Report: Fiserv, Metavanate, Jack Henry, Fidelity, TSYS, Discover, First Data, Visa DPS, MasterCard IPS, Credit Union 24

This report is 43 pages long and has 17 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments industry. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the worlds largest payment issuers, acquirers, processors, and associations to leading technology providers.

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world