Debit Cardholders: Calm Before the Storm

- Date:January 23, 2011

- Author(s):

- Ken Paterson

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Debit Cardholders: Calm Before the Storm

Fourth of Eight Consumer-Based Finding Reports from the

Mercator CustomerMonitor Survey Series

Boston, MA -- Could 2010 be the year of Debit Past? A high water mark for the industry? The peak of consumer usage? As of December 2010, we cannot answer these questions, but we do know that 2011 is likely to be some sort of turning point, as the Durbin Amendment to the Dodd-Frank Act begins its long march toward implementation.

Fourth in a series of eight topical consumer survey reports examining payment and banking topics, Debit Cardholders: Calm Before the Storm highlights consumers growing use of debit cards, just prior to the significant impending changes to debit pricing for consumers, issuers, and merchants.

Based on a national sample of 1,009 online consumer survey panel survey responses focused on payment topics completed between May 10-14, 2010, this data driven report outlines consumer patterns of debit card ownership, usage, preferences for PIN versus signature transactions, awareness of overdraft reform legislation, participation in alternative and decoupled debit programs, and participation in debit card rewards programs.

Highlights of the Debit Cardholders: Calm Before the Storm report include the following:

This 2010 consumer survey documents a sort of high-water mark for consumer debit programs, as the Durbin Amendment to the Dodd-Frank Act begins to re-write program economics for debit issuers, and pricing changes begin to affect consumers and merchants.

At the same time general purpose credit card ownership by households dropped, debit cards became the most widely held type of payment card.

Cardholders are almost evenly split in their preference for PIN transactions, signature transactions, and no preference." But when requested by the merchant, a majority say they comply with a request to enter their PIN.

Private label (decoupled) debit programs sponsored by retailers have gained just a small foothold among debit cardholders.

Debit reward program participation is not dominant among cardholders, and a minority of participants have ever redeemed rewards.

Ken Paterson, VP for Research Operations at Mercator Advisory Group and the author of the report comments, "Looking at the positive achievements of consumer debit programs through our newly acquired Durbin Amendment lens, we must highlight the attributes most likely to change (e.g. rewards programs), procedures potentially causing confusion (e.g. PIN vs. signature transactions), or programs that may experience collateral damage (decoupled debit programs). Many of our 2010 survey results would have been positive indicators for the debit business, but must now be considered candidates for change under debit's emerging pricing realities."

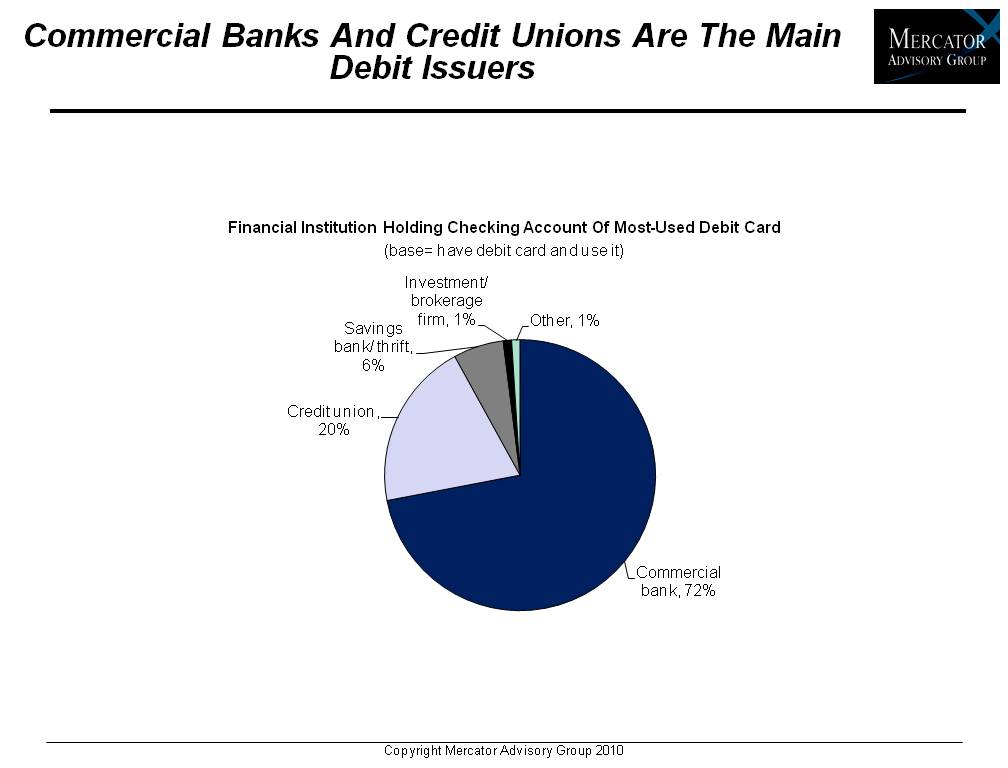

One of the 17 exhibits included in this report.

The report is 35 pages long and contains 17 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world