Overview

New Research Examines Bank's Cross-Selling Strategies Across Multiple Service Delivery Channels

Cross-Selling Through Multiple Channels:

Soft Selling to the Jittery Customer

Boston, MA. -- August 3, 2009 - - The critical element in selling and cross-selling banking products and services is selling the bank itself. In an environment of anxiety and diminished trust in the country's financial institutions, banks must align their brands with the interests and aspirations of their customers. If a bank can synch its very essence with that of its customers, it has earned a position of authenticity and legitimacy from which to speak to customers, hear their issues and offer targeted products and services that lift customers, communities and the institution itself.

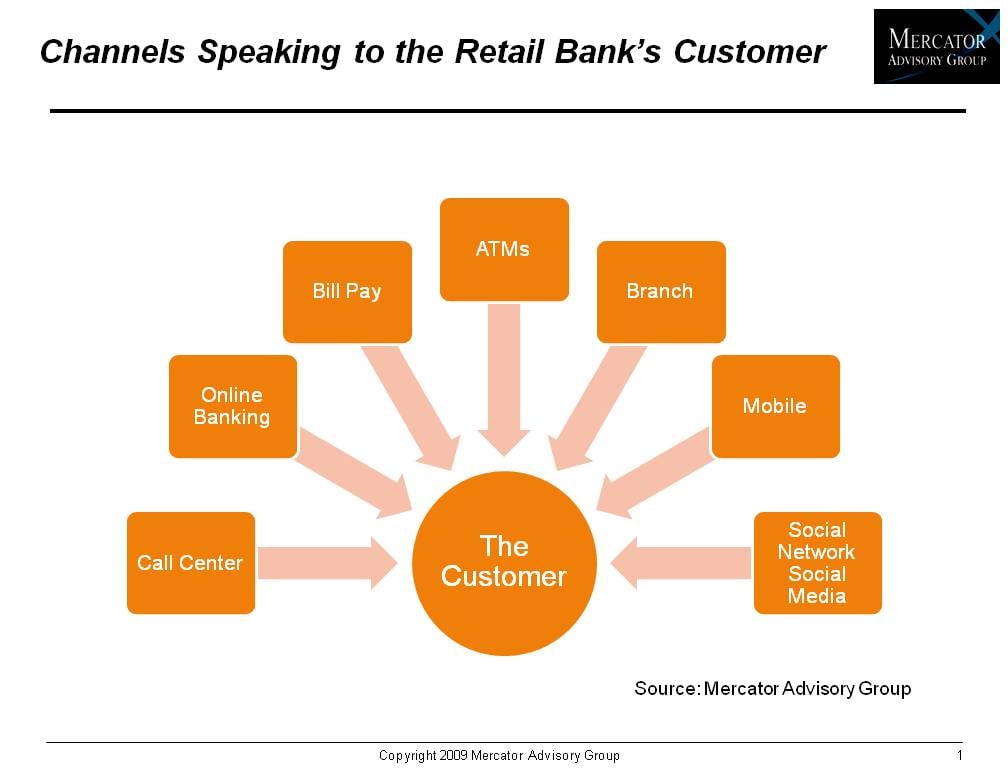

A new report from Mercator Advisory Group's Retail Banking Practice, Cross-Selling Through Multiple Channels: Soft Selling to the Jittery Customer offers an in-depth examination of the principal retail bank channels through which customers touch the bank and identify the best in class banks and vendors optimizing the power of technology and people to best serve and market additional products and account services to customers. The report also identifies and discusses business process hazards undermine the efforts of banks brands, personnel and technologies to deepen their consumer relationships.

The report examines each of the major channels retail banking customers use to transact with their banks and discusses specific products best sold through specific channels. While call centers are best used for the selling of DDA related products, an iPhone app is offered for bill payment and can displace numerous calls to a bank's call center or IVR. Each retail banking channel must shoulder two responsibilities for marketing the bank: It must act as an agent of the bank's brand and it must market that brand even as it aggressively sells customers additional bank products and services.

In the next five years, the channels offering the greatest value for customers and the greatest cross-sell opportunities for banks are the smart phone and, perhaps surprisingly, the branch.

Banks entwining real time communications with real-time banking are making a land grab for new retail banking customers. Smart phone technology is a key banking channel in the reification of real time transactionality which is becoming central in the industry's New Normal.The branch, that iconic image of the banking industry's and the specific bank's brands will be where the bankers sit as they speak via videoconference with their customers. With the ubiquity of laptop and cell phone cameras, at home videoconferencing is poised to take off for banks and their customers. Finally customers will be able to talk about their retirement goals, home refinancing plans or loan restructuring needs in the location that feels most secure and most private: their own home. And not only will those conversations happen at the location of the customer's choosing, but also according to the customer???s schedule. Creating this enormous value for the consumer on the customer???s own terms generates a higher close rate for these cross-selling pitches.

"Cross-selling, with its myriad channels, technology deployments both internal and external to the bank, communication demands, product arrays and business process demands, is clearly a challenging feat within the retail bank," comments Elizabeth Rowe, Group Director of Mercator Advisory Group's Banking Advisory Services and author of the report. "New technology and communication channels can prime the customer's receptivity to a new account or service and while engaging in that soft-sell, needs-based discussion, can concurrently communicate and reinforce the bank's brand. In a time of economic roiling, a collaborative sales approach in which the customer is treated as a full and vested partner, is the key to successful cross-sales efforts. Other new technologies can then be advantaged to clench the sale and deepen the product/relationship ties binding together the bank and the customer."

Report Highlights Include:

- Across all bank service delivery channels, the most important question when positing what-will-I-sell-next is what is the next reasonable product in the financial acquisitional life of the customer? While DDA-related services are always prime sales offerings (and particularly appropriate to the straight-forward interactions of the call center channel), larger, more costly products and services generally are acquired sequentially.

- Cross selling initiatives must be platformed on the bank/credit union brand. In addition to selling the next product to the accountholder, each sales interaction must also advocate for the brand.

- More than products, technology and very human glitches, it is business process hazards that undermine the efforts of banks in their efforts to deepen their customer relationships through account growth and cross-sell their personnel and the prospects of deepening consumer relationships.

- However, with the wave of new social technology channels, products and services engaging bank customers in the marketplace, it is critical that banks test those platforms as venues for communicating, transacting and selling to their customers.

- A bank able to synch its sales products and processes with the interests, needs and schedules of its customers has earned its access to a greater share of its customers??? wallets.

One of the 14 Exhibits included in this report:

This report contains 41 pages and 10 exhibits

Companies Mentioned in This Report: S1, ATG, Bank of America, chatCommerce, Citibank, Diebold, E-LOAN, Facebook, FDIC, First Tennessee Bank, ING Direct Canada, J.D. Power and Associates, JPMorgan Chase, LivePerson Business Solutions, Maritz, National Australia Bank, Quick & Reilly, TD Bank, U.S. Bank, Wells Fargo

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the banking and payments industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, and associations to leading technology providers.

Book a Meeting with the Author

Make informed decisions in a digital financial world