Cross Border Payments: U.S. Bank Imperiled by Lagging Deployment of Real Time Gross Settlement Systems

- Date:December 10, 2008

- Author(s):

- Mercator Research

- Research Topic(s):

- Digital Banking

- PAID CONTENT

Overview

Boston, MA

December 2008

Cross Border Payments: U.S. Banks Imperiled by Lagging Deployment of Real Time Gross Settlement Systems

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

In 2006, $2.5 trillion dollars in foreign exchange, cross border payments were settled each day. While cross-border payments will continue to grow in both dollar volumes and number of transactions, their foreseeable growth rate, tracking overall global economic trends, will dramatically slow.

This report from Mercator Advisory Group's Corporate Banking Practice examines the global payments landscape focusing on the emerging Real-time Gross Settlement Systems poised to gain universal standards adoption. That standardization is the platform bedrock allowing cross-border payments systems to seamlessly work together, reducing risk for the multiple payments stakeholders in global trade.

Emerging real time gross settlement systems are being adopted across the European Union and by the central banks of emerging market powerhouses. Unfortunately, the U.S. banks, held captive by their legacy payments systems, have forfeited their leadership role in the facilitation of cross-border payments. While the United States remains the world's leading importer and exporter of goods and services, its commercial banks for losing market share and millions of dollars of revenues as settlement responsibilities migrate to the leading banks of other nations.

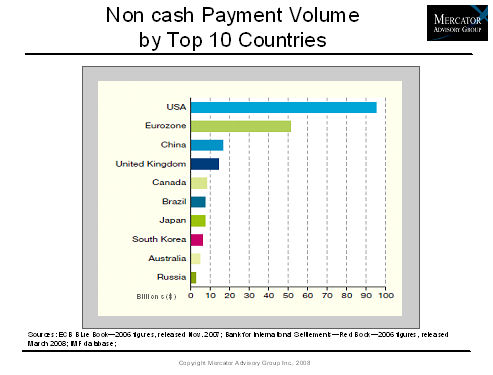

One of the 16 Exhibits included in this report

This report is 39 pages long and contains 16 exhibits.

Book a Meeting with the Author

Related content

What Lenders Can Learn from Fintech Chatbots

Javelin’s diagnostic analysis of AI-powered consumer-facing chatbots for 11 fintechs, non-bank lenders, and retail banks found that retail FIs consistently fail to provide personal...

The Invoicing Gap: How Small Businesses Get Paid, and Why Banks Are Missing Out

Invoicing is one of the most fundamental workflows in running a small business, sitting at the center of getting paid, managing cash flow, and maintaining customer relationships. Y...

How to Make Bank Websites a Better Place to Learn, Shop, and Buy

Javelin Strategy & Research’s analysis of online public websites for five leading FIs—Ally, Bank of America, Chase, Chime, and U.S. Bank—indicates that shopping for a financial pro...

Make informed decisions in a digital financial world