Credit Scoring as a Competitive Differentiator

- Date:November 21, 2016

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Automated credit scoring, an innovation pioneered by FICO during the 1950s, serves the global credit card business well, but saturated markets need to develop new customer streams to fuel growth and offset attrition.

New methods to discover potentially creditworthy new customers outside the bounds of traditional credit scoring are emerging for both consumer credit and small business credit. Credit cards have a particular need to reach beyond traditionally saturated customer segments such as high net worth and mass affluent. Small businesses with limited credit history also have an urgent need for credit.

Mercator Advisory Group's latest research report, Credit Scoring as a Competitive Differentiator, discusses how traditional score functionality adapts to the current market and the potential of disruptive models.

"In order to maximize lending opportunities, lenders must stay at the forefront of credit scoring innovation," comments Brian Riley, Director, Credit Advisory Services, Mercator Advisory Group, author of the report. "Some innovations are exciting but have not been proven through stressful business cycles, so be certain to balance risk and reward."

This report contains 28 pages and 15 exhibits.

Organizations mentioned in this research report include: Barclaycard US, Branch.co. Consumer Financial Protection Bureau (CFPB), Equifax, Experian, Federal Reserve Bank of Philadelphia, Federal Trade Commission (FTC), FICO, Capital One, Discover, Lending Club, Lenddo, LexisNexis, Mintel Comperemedia, On Deck Capital, Prosper Marketplace, Small Business Financial Exchange (SBFE), Social Finance (SoFi), TransUnion, U.S. Department of the Treasury, ZestFinance.

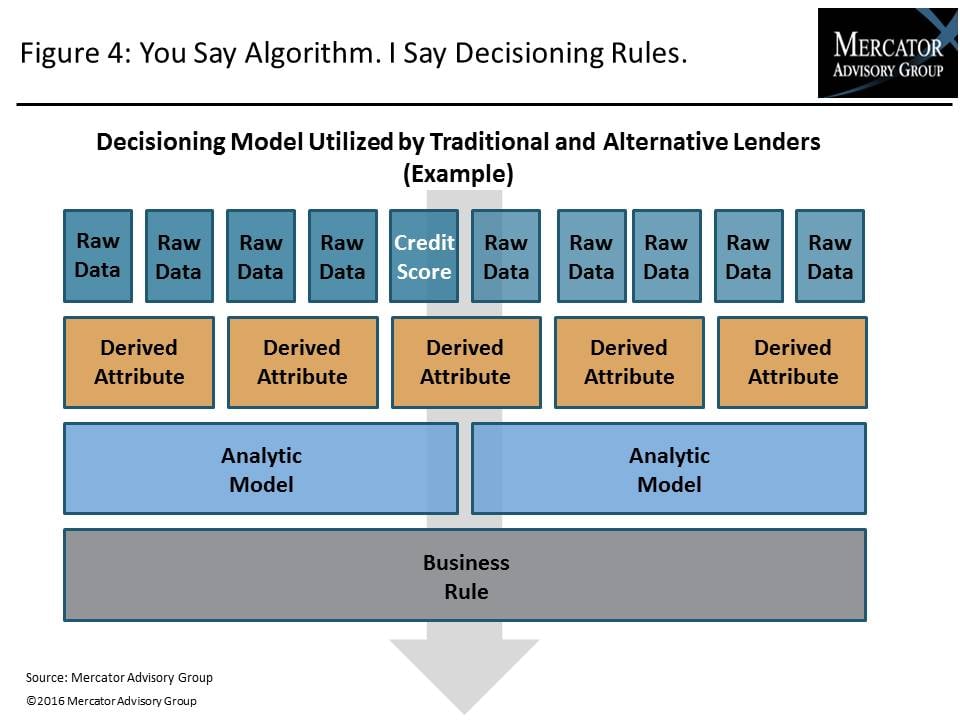

One of the exhibits included in this report:

Highlights of the research report include:

- Alternative lenders posing retention issues for traditional institutions

- Reaching underserved customers

- Alternative methods for determining creditworthiness

- A new approach to customer engagement

- Using credit scoring to build deeper customer relationships

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world