Consumers and Retail Banking Channels: Old Channels Never Die

- Date:April 24, 2011

- Author(s):

- Ken Paterson

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Consumers and Retail Banking Channels:

Old Channels Never Die

The fifth of eight reports from Mercator Advisory Group's CustomerMonitor Survey Series plots a baseline of consumer bank channel usage information

Boston, MA -- Before the electronic age, bankers had to be concerned about physical channels (branch and possibly mail), and a bit of non-transactional conversation over the phone. Of course, electronics changed all that, by adding ATMs, phone (VRU and call center), online, online chat, SMS text, remote deposit capture, and now mobile and video channels . . . so far.

The physical branch, surely the oldest bank channel, shows no indication of passing, although Mercator Advisory Group consumer data does suggest the role of the branch will continue to shift away from a central transactional role, to something more akin to a store, as a number of leading banks have espoused. And while the frequency of customer visits may be on a slow decline, as discussed in this consumer-based response report, branches continue to figure prominently in consumers' selection criteria for banks. In financial services where so much is intangible, branches offer an important point of reference to potential buyers.

The fifth in a series of eight topical consumer survey reports from Mercator Advisory Group's CustomerMonitor Survey Series examining payment and banking topics, Consumers and Retail Banking Channels: Old Channels Never Die highlights consumers' complex relationships with retail banking delivery channels.

The foundation of this analysis is a national sample of 1,010 online consumer survey panel survey responses (focused on banking channel topics) completed between September 9-13, 2010. This research outlines consumer patterns of financial institution usage, use of banking delivery channels (including branch, online, ATM, mobile, e-mail, call center, and other channels), and channel-related experiences and preferences.

Findings and highlights of the report include the following:

Most respondents' households have relationships with full-service banks with branches, and a majority identifies a bank as their primary financial institution.

Measurements of multiple bank selection characteristics and ratings of various concerns consumers consider when choosing a bank for a checking or savings account.

Most common reasons consumers switch their primary financial institution.

In-branch, face-to-face communications are the most widely used and preferred bank communication channels, including CSRs and tellers.

Teller and ATM interactions to make deposits and withdrawals still dominate consumers' reasons to visit a branch. Branches continue to dominate deposit gathering, although online/non-branch banks are making inroads.

Ken Paterson, VP for Research Operations at Mercator Advisory Group and author of the report comments, "While the electronic revolution continues to proliferate consumer banking delivery channels, it is difficult to envision the retirement of old channels. The physical branch, surely the oldest channel, shows no indication of passing. And while the frequency of customer visits may be on a slow decline, branches continue to figure prominently in consumers" selection criteria for banks. Delivery channels present a long and challenging list for bankers to manage, with a stream of new devices that may only add to the menu."

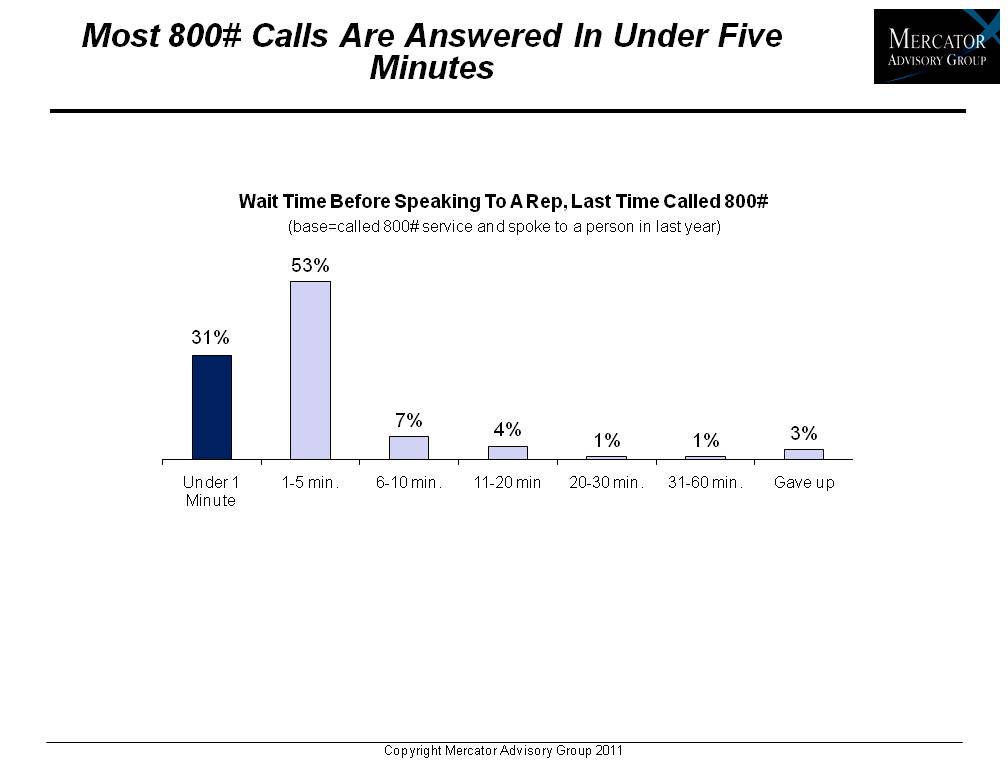

One of the 16 exhibits included in this report.

The report is 36 pages long and contains 16 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: Canada: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 22 – 30, 2025, using a Canadian online...

Make informed decisions in a digital financial world