Consumers and Prepaid: Shifting Toward Digital

- Date:September 07, 2018

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group’s most recent Insight Summary Report, Consumers and Prepaid: Shifting Toward Digital, based on the annual Payments survey in the CustomerMonitor Survey Series conducted in June 2018, reveals that after five years of steady growth from 2012 to 2016 in the United States, consumer purchase of prepaid cards retreated to 2014 levels and maintained that level in 2018. The survey finds that 56% of U.S. adults bought prepaid cards in the year preceding both the June 2018 and June 2017, down from 63% in 2016, but up from 47% in 2012.

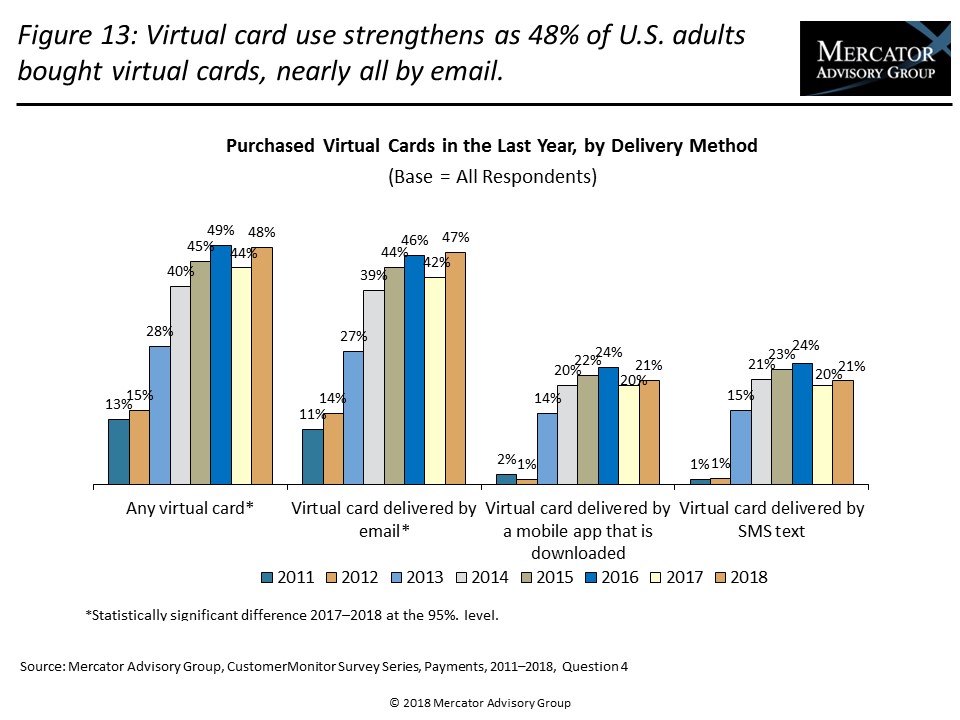

Purchase of virtual prepaid cards delivered digitally remains strong, bought by 48% of U.S. adults, nearly equivalent to 2016 figures after years of steady growth. Virtual cards are usually delivered by email, but nearly half of buyers say they bought virtual cards using SMS text or via a downloaded mobile app. Virtual prepaid cards encompass cards from a wide variety of services and merchants. Retailer cards are the most popular type (16% of all respondents bought retailer-specific virtual cards in the previous year), although most retailer-specific prepaid cards are still purchased as physical cards.

The new Mercator Advisory Group report Consumers and Prepaid: Shifting Toward Digital presents survey findings based on responses to an online survey of 3,002 U.S. adults conducted in June 2018 as part of the CustomerMonitor Survey Series. The report examines a demographic shift of prepaid card and virtual card buyers and the changing landscape of prepaid card use and loads on cards as recalled by survey respondents. The shift toward virtual cards delivered digitally in each of seven categories is highlighted. Survey findings cover usage, frequency, distribution channels, the relative importance of feature sets and fees, incremental value and visits, and brand awareness and current or previous use of 13 major brands of general purpose reloadable (GPR) cards, consumers’ reasons for discontinuing use, as well as awareness, reload, and use of direct deposit onto GPR cards.

The shift toward virtual cards, which is particularly strong in the retailer gift card segment, is fostered by the growth of e-commerce and m-commerce. Young adults remain the most likely buyers of prepaid cards in all segments, especially those who pay by mobile phone. Online and mobile channels are often supported by online payment services using new, emerging payment technologies where traditional bank cards are often loaded and in “one-click,” card-on-file scenarios, they become a default payment.

“The stagnation in prepaid buying recorded by the latest CustomerMonitor Survey after a dip in 2017 is a continued sign of turbulence in the prepaid market and is confirmed anecdotally by some program managers. The growth of PayPal Mastercard, a current market leader, is shaping the role of prepaid in emerging markets, reaffirming the impact of digital channels on prepaid,” states the author of the report, Karen Augustine, manager of Mercator Advisory Group’s Primary Data, which includes the CustomerMonitor Survey Series.

The report is 85 pages long and contains 43 exhibits.

Companies mentioned in this report are: American Express, Chase, Green Dot, H&R Block, Netspend, PayPal Mastercard, Univision, RushCard, and Walmart, Western Union.

One of the exhibits included in this report:

Highlights of this survey and report include:

- Year-over-year trending of prepaid card use by eight categories of prepaid cards (including retailer-specific, general purpose, and reloadable cards) and U.S. consumers’ recollection of cards purchased and monthly load volume

- Shifts in the demographics of prepaid card and virtual card users and the ways U.S. consumers use them

- Categories of retailer-specific cards used

- Likelihood of incremental spend by spending more than the value of card, visiting more often, buying additional items, or buying more expensive items

- Locations used to buy prepaid cards and virtual cards for self and as gifts

- Awareness and use of online gift card exchanges

- Purchase behavior regarding general purpose reloadable, or GPR, cards, including length of time the card is in use, load frequency, and awareness and use of direct deposit to GPR cards

- Brand awareness, purchase, timing, and current use of 13 GPR card brands

- Importance of key features of GPR cards and the amount held in interest-bearing savings accounts in GPR card

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world