Consumers and Prepaid: Caution Ahead

- Date:September 13, 2017

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

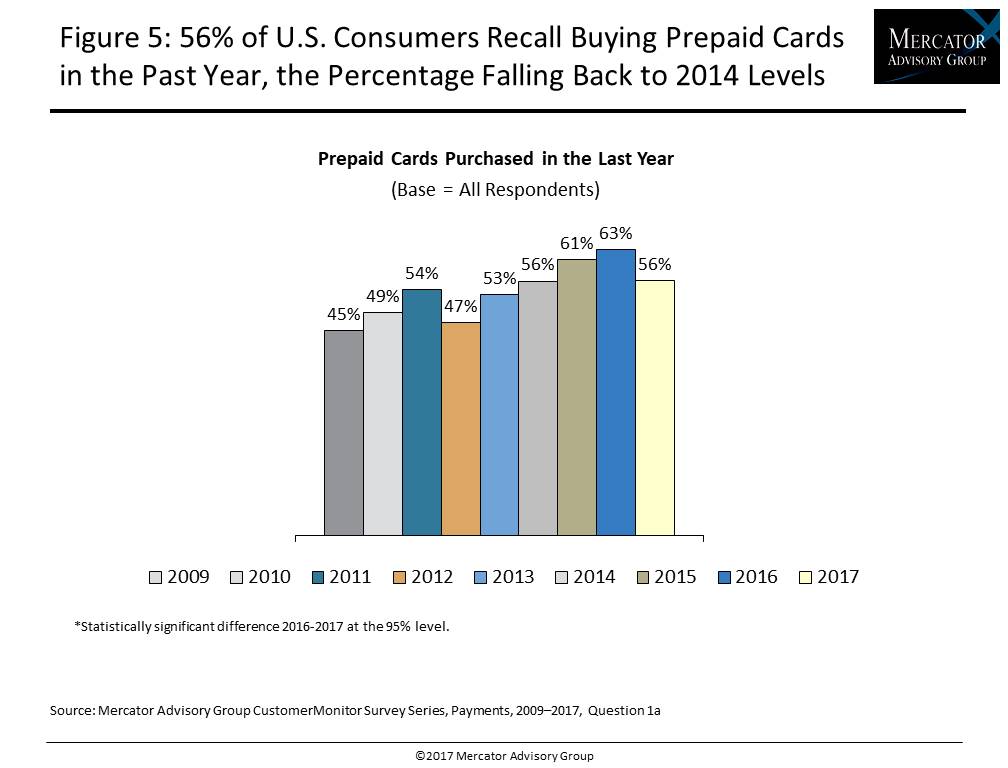

Mercator Advisory Group’s most recent Insight Summary Report, Consumers and Prepaid: Caution Ahead, based on the annual Payments survey in the CustomerMonitor Survey Series conducted in June 2017, reveals that after five years of steady growth, U.S. consumers appear to be cutting back on buying prepaid cards this year, returning to 2014 buying levels. The survey finds that 56% of U.S. adults bought prepaid cards in the year preceding the June 2017 survey, down from 63% in 2016, but up from 61% in 2015, 56% in 2014, 53% in 2013 and 47% in 2012. Retailer-specific cards continue to be the most popular type of prepaid cards, bought by 38% of U.S. adults, down from 45% in 2016, but up from 41% in 2015. Yet, fewer U.S. adults bought prepaid cards in any of the eight categories tracked in the annual survey—retailer-specific cards, general purpose reloadable (GPR) cards, general purpose nonreloadable cards, gift cards for online services, prepaid mobile phone cards or virtual cards, long distance phone cards, and transit cards. However, GPR cards showed less volatility than other types of cards.

The new Mercator Advisory Group report Consumers and Prepaid: Caution Ahead presents survey findings based on responses to an online survey of 3,011 U.S. adults conducted in June 2017 as part of the CustomerMonitor Survey Series. The report examines a demographic shift of prepaid card and virtual card buyers and the changing landscape of prepaid card use and recalled loads, highlighting eight categories of prepaid card types. Survey findings cover usage, frequency, distribution channels, the relative importance of feature sets and fees, and brand awareness and current or previous use of 11 major brands of general purpose reloadable cards, reasons for discontinuing use, as well as awareness and use of direct deposit onto general purpose reloadable (GPR) cards.

Much of the growth in prepaid had been from the young adults, particularly 25–34 year olds, mobile-enabled users, high-income earners and Hispanics. However, these segments are also among the most likely to have shied away from prepaid this year. This may be due to the flux in the retailer segment with the growth of the e-commerce and m-commerce, which has resulted in losses for many brick-and-mortar retail operations leading some major merchants to close numerous stores. Meanwhile, digital shopping and payments are growing, and often facilitated by online payment services using new, emerging payment technologies where traditional bank cards are often loaded.

“The recent dip in prepaid buying recorded by the latest CustomerMonitor Survey is a signal that issuers should beware and increase accessibility of their cards online and by mobile, given that prepaid cards lock in spend, foster loyalty, and generate significant incremental spend,” states the author of the report, Karen Augustine, manager of Primary Data at Mercator Advisory Group including the CustomerMonitor Survey Series.

The report is 84 pages long and contains 37 exhibits

Companies mentioned in this report are: American Express, Chase, Green Dot, H&R Block, NetSpend, PayPower, RushCard, and Walmart.

One of the exhibits included in this report:

Highlights of this survey and report include:

- Year-over-year trending of prepaid card use by eight categories of prepaid cards (including retailer-specific, general purpose, and reloadable cards) and consumers’ recollection of cards purchased and monthly load volume

- Shifts in the demographics of prepaid card and virtual card users and the ways consumers use them

- Categories of retailer-specific cards used

- Likelihood of incremental spend by spending more than the value of card, visiting more often, buying additional items, or buying more expensive items

- Locations used to buy prepaid cards and virtual cards for self and as gifts

- Awareness and use of online gift card exchanges

- Purchase behavior regarding general purpose reloadable, or GPR, cards, including length of time the card is in use, load frequency, and awareness and use of direct deposit to GPR cards

- Brand awareness, purchase, timing, and current use of 11 GPR card brands

- Importance of key features of GPR cards and the amount held in interest-bearing savings accounts in GPR card

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world