Consumers and Debit 2013: A Shift to Alternative Payments

- Date:December 12, 2013

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

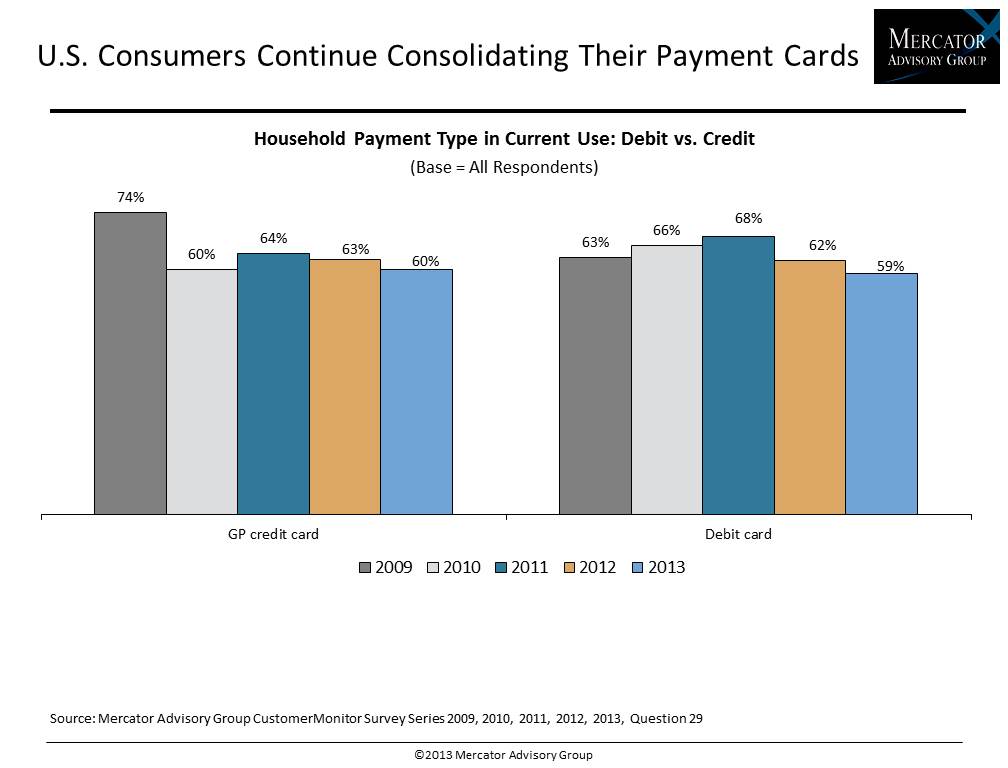

Boston, MA –December 12, 2013 –Mercator Advisory Group’s third in a series of eight Insight Reports presenting findings of the 2013 CustomerMonitor Survey Series reveals that debit card penetration in the United States declined over the past two years from a high of 68% in 2011 to a new low of 59% in 2013, as more consumers began using prepaid cards and nontraditional payment forms.

Consumers and Debit 2013: A Shift to Alternative Payments, the latest report from Mercator Advisory Group’s Primary Data Service, shows that demographics of debit card users in the U.S. are changing. For the first time in five years, young adults, who have been more likely than average to use debit cards, are now no more likely than average to use a debit card. Debit card penetration of households that earn less than $75,000 a year is also declining faster than average. At the same time, use of general purpose reloadable prepaid cards is growing, particularly among young adults, although it is still minimal. With half of consumers using check cashing, bill payment, money transfers, payday advance/short-term loans, and rent-to-own arrangements, more consumers are not using these financial services from banks or credit unions. Three-quarters of those who buy money orders and over half of those who initiate money transfers do so from alternative financial service organizations including supermarkets, discount stores, and convenience stores.

This study examines the demographic shift and changing landscape of debit card use, use of a broad range of payment services, brand awareness and use of eight brands of payment services, channel used for alternative payment services, account opening experiences, awareness of new fees and reaction to those fees, other changes to checking accounts and interest in new services for debit cards and willingness to pay for each service.

The report presents the findings from Mercator Advisory Group’s CustomerMonitor Survey Series online panel of 3,003 U.S. adult consumers surveyed between May 28 and June 6, 2013.

“There can be no doubt that the Durbin Amendment to the 2010 Dodd-Frank financial reform act is taking a toll on debit card ownership. Debit account fees that many banking institutions have found necessary to charge to compensate for revenue they lost due to Durbin’s limits on debit card swipe fees appear to be leading important segments of the growing underserved population to shift to alternative financial services. Young adults who might have opened debit accounts appear to be thinking twice about debit cards in favor of other, nontraditional payment forms,” states Karen Augustine, manager of Primary Data Services including CustomerMonitor Survey Series at Mercator Advisory Group and author of the report.

The report is 60 pages long and contains 29 exhibits

Members of Mercator Advisory Group CustomerMonitor Survey Series Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trending of debit card ownership in the U.S. and the ways that consumers use debit cards

- A shift in demographics of debit cardholders

- Comparison of use of traditional financial services such as banks and credit unions with use of alternative services such as supermarkets, discount stores, and specialty outlets

- Statistics on U.S. consumers’ use of various payment services, and their awareness and use of eight major brands

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: Canada: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 22 – 30, 2025, using a Canadian online...

Make informed decisions in a digital financial world