Overview

Understanding and Acting upon Consumers’ Preferences for Debit Cards

Debit cards have many advantages over other payment types. Particularly for younger, lower-income individuals, debit is a great choice for managing costs, managing risk, and the need for convenience. Compared to credit, debit has no risk of debt, no risk of a negative credit score impact, no annual fee, and no interest charges.

Mercator Advisory Group’s most recent report, Consumer Payment Choice: Understanding Debit Card User Preferences, pulls from a wealth of primary data to form an overview of the typical user. Looking at consumers who indicate a preference for debit transactions, the report reveals key demographic traits of those most likely to rely on their cards.

The report then goes on to explore the many use cases, providing insights into the consumer segments most likely to use debit in particular circumstances. Embedded within this analysis are recommendations for debit card issuers and processors intended to support customer engagement and debit utilization.

“85% of U.S. adults have a debit card, spanning across all age groups, income brackets, and education levels. However, differences appear when preference for debit payments is considered. It is critical for issuers and processors to have a solid understanding of who prefers to use debit cards and under which circumstances in order to better target marketing and rewards initiatives most effectively,” stated the author of the report, Laura Handly, senior analyst at Mercator Advisory Group.

This report is 22 pages long and contains 18 exhibits

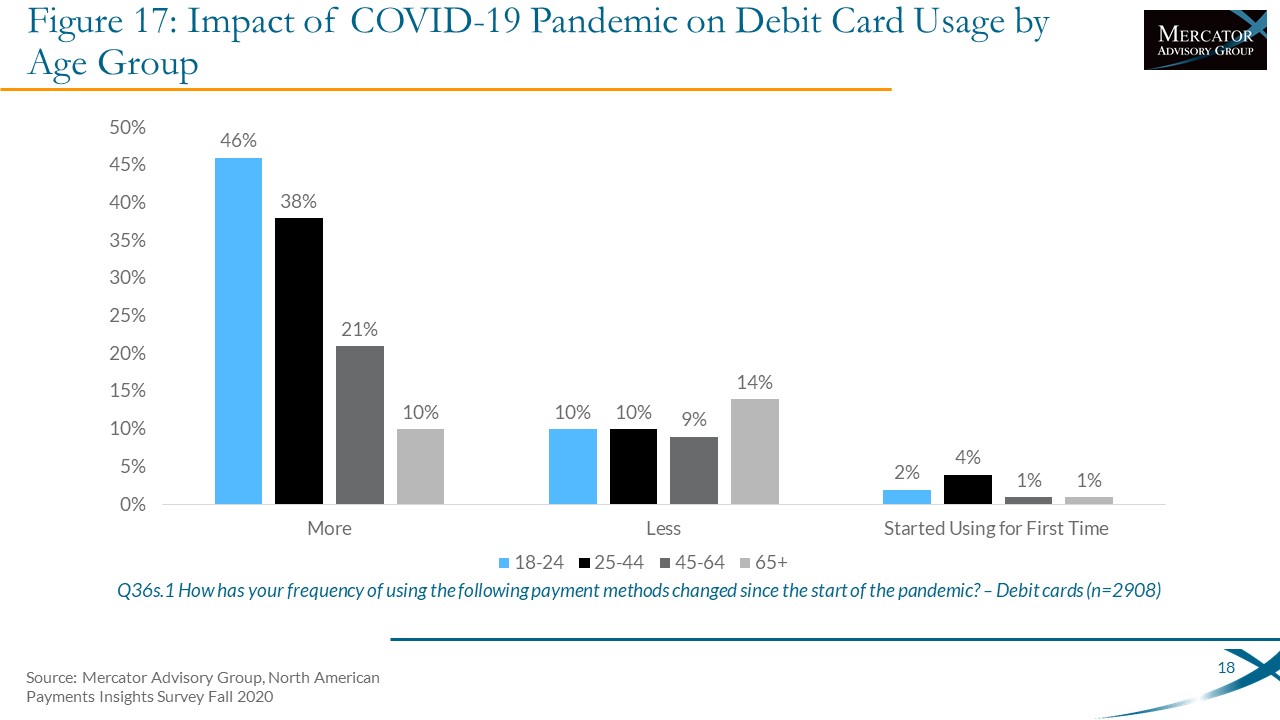

One of the exhibits included in this document:

Highlights of this document include:

- An examination of the “typical” user across a number of demographic categories

- An exploration of consumer preferences across debit use cases

- A detailed exploration of Mercator Advisory Group’s primary data on consumers’ utilization of debit

- Recommendations for issuers and processors

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world