Commercial Credit Cards: International Markets Review and Forecast, 2019-2024

- Date:June 29, 2020

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

The commercial credit card market for mid-to large corporates in regions outside of North America has been in a generally strong growth mode for the past several years. In these markets, spending growth remains underpinned by corporate cards, used mostly for travel and entertainment (T&E), as well as virtual cards used to settle with travel management companies, although some additional penetration into other verticals has occurred in both Europe and Asia Pacific. The consequent spending volume in corporate cards is closely tied to travel budgets and general corporate adoption, therefore the pandemic is causing a major spending downturn in 2020. The utilization of purchasing cards (P cards) and non-travel virtual cards are more directly tied to broader economic activity, the growing use of electronic payments methods, and replacement of checks and cash in the payables process.

Mercator Advisory Group’s latest research report, Commercial Credit Cards: International Markets Review and Forecast, 2019-2024, provides a detailed review of the commercial credit card markets in four broad regions, including Western Europe, Asia Pacific, Latin America and Caribbean, as well as Central & Eastern Europe, Middle East and Africa. Each regional breakdown includes an analysis of how the pandemic impacts spend during 2020-21, as well as recovery expectations through 2024.

“The pre-pandemic growth trajectory was quite good overall across these regions, although still mostly dependent on business travel,” commented Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service, author of the report, “so regaining that momentum is going to require a greater emphasis on card rails utilization in payables, while also re-capturing travel spend as it returns.”

This report is 18 pages long and has 10 exhibits.

Companies and other organizations mentioned in this report include: American Express, BC Card, Conferma Pay, Diners Club, Express Technology Services, Global Business Travel Association (GBTA), International Monetary Fund (IMF), JCB, LianLian DigiTech Co. Ltd, Mastercard, National Payment Card System (NSPK), Union Pay, Visa

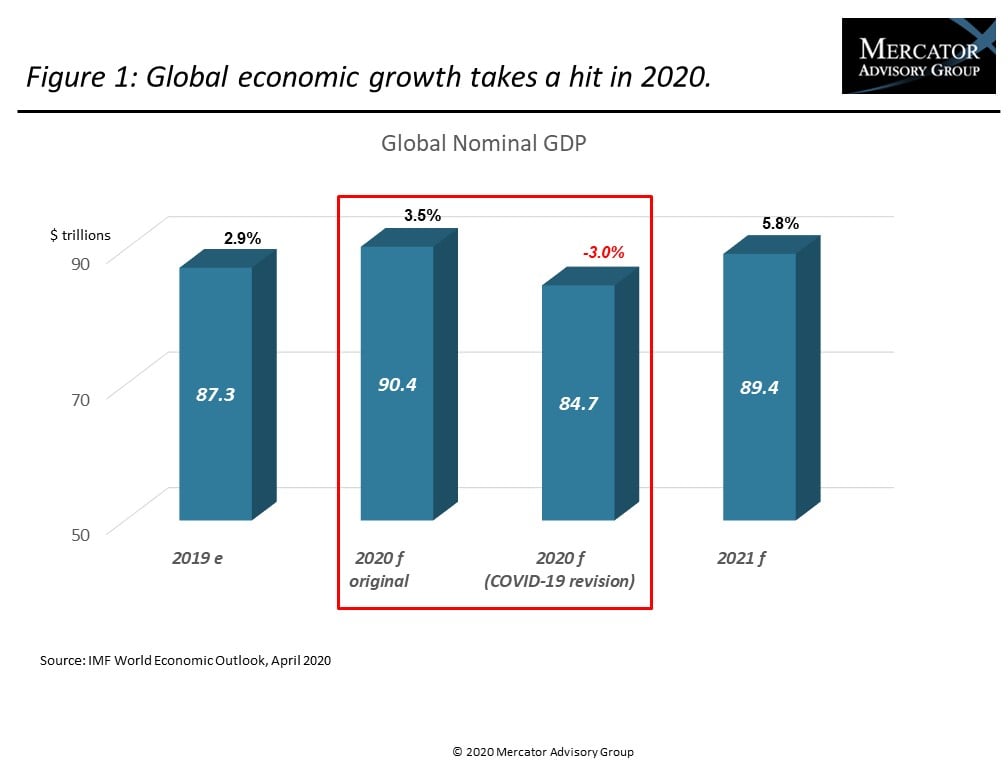

One of the exhibits included in this report:

Highlights of the report include:

- A review of the economic impact that COVID-19 is having globally and in each region.

- Correlation analysis between overall regional credit card spend and the economic downturn through 2021.

- Commercial credit card spending forecasts for each major region through 2024.

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world