Overview

Around the world, cash remains a significant consumer payment instrument, but as the 21st century shopping experience evolves, consumers who use cash exclusively or almost exclusively will be disadvantaged as goods and services increasingly move online.

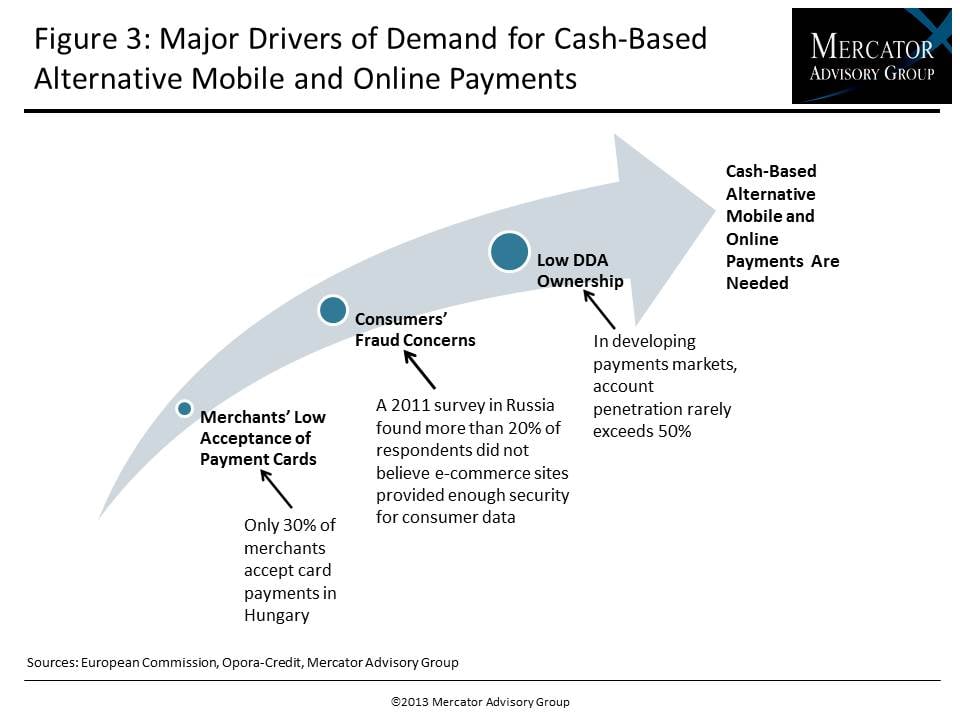

In many countries, in response to the prevalence of cash for payments as well as to the low percentage of consumers with checking bank accounts and consumers' concerns over the security of transmitting sensitive personal and financial details online, firms have stepped up to provide cash based alternative online and mobile payment services. These services enable consumers to pay with cash for purchases they can initiate online or with their mobile phones.

"New technologies and services that reflect evolving consumer trends in mobile phone and Internet use have emerged in markets that still have a cash culture. Today, these firms provide services that accept cash at agents, kiosks, or full-service bank branches to enable consumers to pay for goods and services without ever having to share sensitive personal and financial information or even have a bank account. The latter is particularly significant in developing countries, where demand deposit account (DDA) ownership rarely exceeds 50%," comments Tristan Hugo-Webb, Associate Director for the International Advisory Service at Mercator Advisory Group and the primary author of the report.

The report is 25 pages long and contains 8 exhibits.

Companies mentioned in this report include:Amazon, cashU, QIWI, Qoo10, and Ukash

Members of Mercator Advisory Group's International Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

One of the exhibits included in this report:

- Overview of cash usage trends in leading developed and developing countries

- A look at the global increase in non-cash-based transactions

- An in-depth examination of leading factors in the popularity of cash-based alternative online and mobile service providers

- Profiles of leading and interesting providers cash-based alternative online and mobile service in markets around the world

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world