Branch Banking 2012: All About the Relationship - Cross Tabs

- Date:February 21, 2013

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Fifth report from Mercator Advisory Group's 2012 CustomerMonitor Survey Series probes customer usage of branches, communication methods, and attitudes toward remote banking technologies

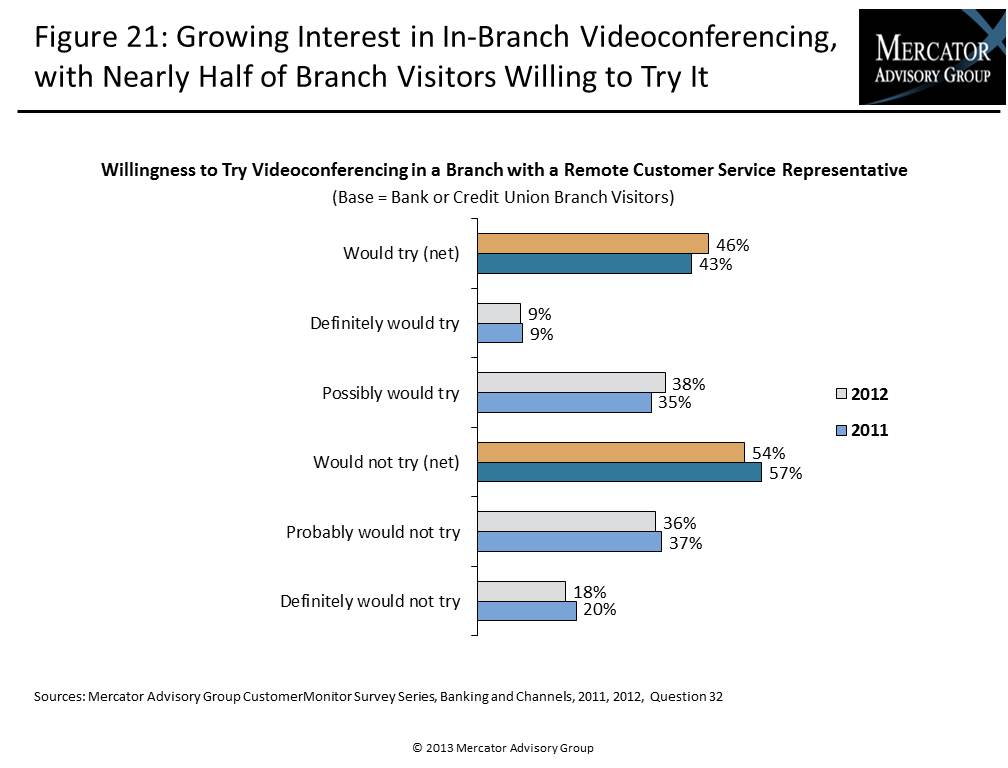

Branch banking remains a vital means for financial institutions to forge stronger customer relationships and cross-sell products and services. In today's digital environment, FIs must reinvent the branch experience to make branches more compelling places to visit, and innovations such as new remote teller technologies and videoconferencing are serving to enhance the customer experience. Nearly half of Mercator Advisory Group survey respondents indicated that they would try videoconferencing with a customer service representative or product specialist if no branch representative or specialist were available in person.

Report findings are based Mercator's CustomerMonitor Survey Series. The foundation of the series is data obtained during a national sample of 1,008 online consumer survey responses completed between October 23 and November 2, 2012.

"Branch banking is not going away, but it does need to evolve. The branch, even in the digital age, will remain a key sales tool for the financial institution to develop and expand customer relationships," states Karen Augustine, manager of CustomerMonitor Survey Series at Mercator Advisory Group and the author of the report.

One of the exhibits included in this report:

- Year-over-year trending of the number/types of financial institutions used by consumers, the institutions they consider their primary FI, usage of the primary institution's credit card, and types of financial advisors

- Shifts in communication methods with FIs, satisfaction with those methods, and preferred type of branches

- Reasons for branch usage, frequency of visits, and interaction with branch staff

- Highest-ranking methods of learning about new financial products and services

- Trends surrounding the interest in-branch videoconferencing

The report is 52 pages long and contains 21 exhibits

Members of Mercator Advisory Group CustomerMonitor Survey Series Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world