Overview

<?xml encoding="utf-8" ?>

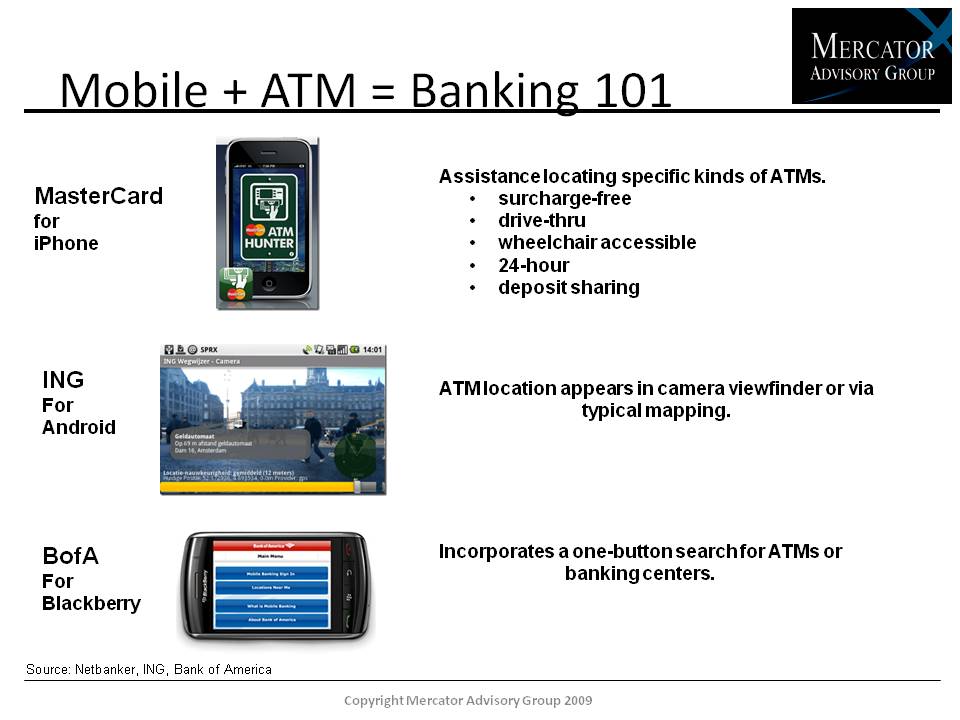

Automated Teller Machines, The Other Self Service

Boston, MA -- Jan. 08, 2010 -The fact remains that a large majority of consumers still use ATMs for access to cash and not much else. Yet, upon examining the state of the ATM market as we prepare to enter the next decade of the new millennium, we can see that it is in no way operating in a static environment. The ATM of tomorrow is here today and some financial institution in the U.S. are upgrading their fleet of terminals to offer advanced functions, finally enabling traditional bank ATMs to operate as financial services kiosks. Yet, this strategy is not enacted without expert advice; setting the stage for opportunities in ATM managed and outsourced services.

Mercator Advisory Group???s the Automated Teller Machines, The Other Self Service report examines the ATM market from the perspective of the current economic and technical environment. We consider how these forces are meeting changing consumer needs and preferences for accessing not only cash, but more broadly, services traditionally supported in-branch.

???We suggest that the ATM market, as it enters 2010, while outwardly similar in consumers propensity to use these devices to get cash, is also entering a development phase offering stronger opportunities than ever before for stakeholders across the value chain." Patricia Hewitt, Director of Mercator Advisory Group???s Debit Advisory Service comments. "Consumers are embracing self service strategies, financial institutions are looking for ways to improve their brand and reach a larger accountholder base at a lower cost, and product developers are creating hardware and software that effectively respond to a dynamically changing market.???

Highlights of this report include:

An analysis of the impact advanced function ATMs are having on the market.

The changing nature of ISO organizations.

Opportunities in advancing the market for ATM managed and outsourced services.

An examination of surcharge free networks.

How the traditional ATM market is changing to keep pace with consumer???s interest in access to self-service functions.

One of 14 exhibits in this report:

This report is 24 pages long and has 14 exhibits.

Companies mentioned in this report include: Cardtronics, Allpoint, Cu Anytime, Select A Branch, Co Op Financial Services, CU24, MoneyPass.

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world