ATM Banking: It’s Not Just About Cash Withdrawal Anymore

- Date:June 06, 2019

- Author(s):

- Peter Reville

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group’s most recent Insight Summary Report, ATM Banking: It’s Not Just About Cash Withdrawal Anymore, reveals that U.S. customers are increasingly relying on ATMs to fulfill their banking needs. The report is from the Banking and Channels Survey in the bi-annual CustomerMonitor Survey Series, a part of Mercator’s Primary Data Service. It is based on findings from Mercator Advisory Group’s CustomerMonitor Survey Series online survey of 3,000 U.S. adult consumers in November 2018.

Among many insights uncovered, the survey found consumers are more than four times as likely to use their own bank’s ATM (94%) as other banks’ ATMs (22%) or ATMs than are not bank branded (19%). Furthermore, heavy users of ATMs are less dedicated to their own bank’s ATM and more apt to use ATMs that do not belong to their bank. The same is true of younger consumers, reflecting their strong presence among the heavy users of ATMs.

The survey also found that consumers are more likely to choose going to a teller when depositing higher-denomination checks (e.g., $1,000) than to deposit them in an ATM. Checks of smaller denomination (e.g., $50) are more apt to be deposited via an ATM. Additionally, the report shows that 14% of Americans say they will not withdraw cash at an ATM and 31% will not conduct any other type of transaction at an ATM.

“There is an opportunity for financial institutions to deepen their relationship with their customers by expanding the capabilities of their ATMs. Younger consumers rely more on ATMs and use more of their features. As such, this group should be kept in mind during any discussions of or planning for new functionality,” stated the author of the report, Peter Reville, Director of Primary Data Services at Mercator Advisory Group including the CustomerMonitor Survey Series.

This Insight Summary Report has 42 pages in slide form.

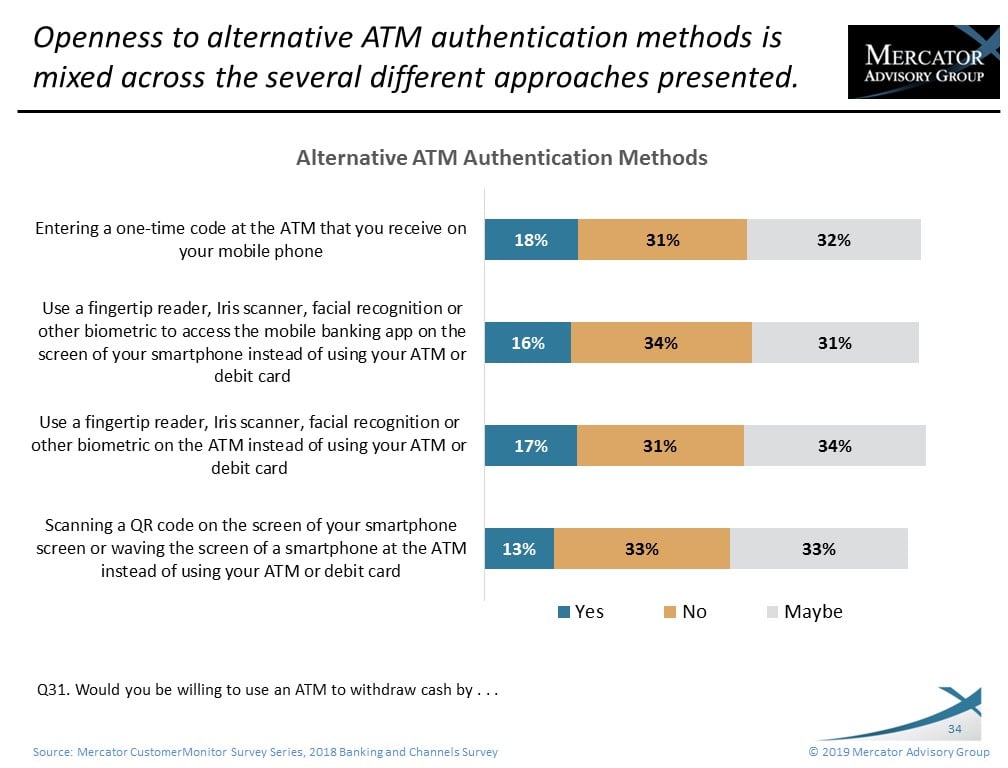

One of the exhibits included in this report:

Highlights of this report include:

- Not surprisingly, interest in new types of ATM transaction is heavily skewed toward the heavy users of ATMs users rather than light users.– Heavy ATM users are about three times as interested as those who are light users.

- Regarding interest in alternative methods of authentication, the results are virtually the same for each method queried (QR code on mobile phone or on ATM, biometric via phone or via ATM).– About one-third of consumers surveyed are not interested in any of these authentication methods.– Similar percentages are willing to consider them

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: Canada: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 22 – 30, 2025, using a Canadian online...

Make informed decisions in a digital financial world