ATM and Self-Service Banking: Key to Engagement

- Date:March 17, 2017

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

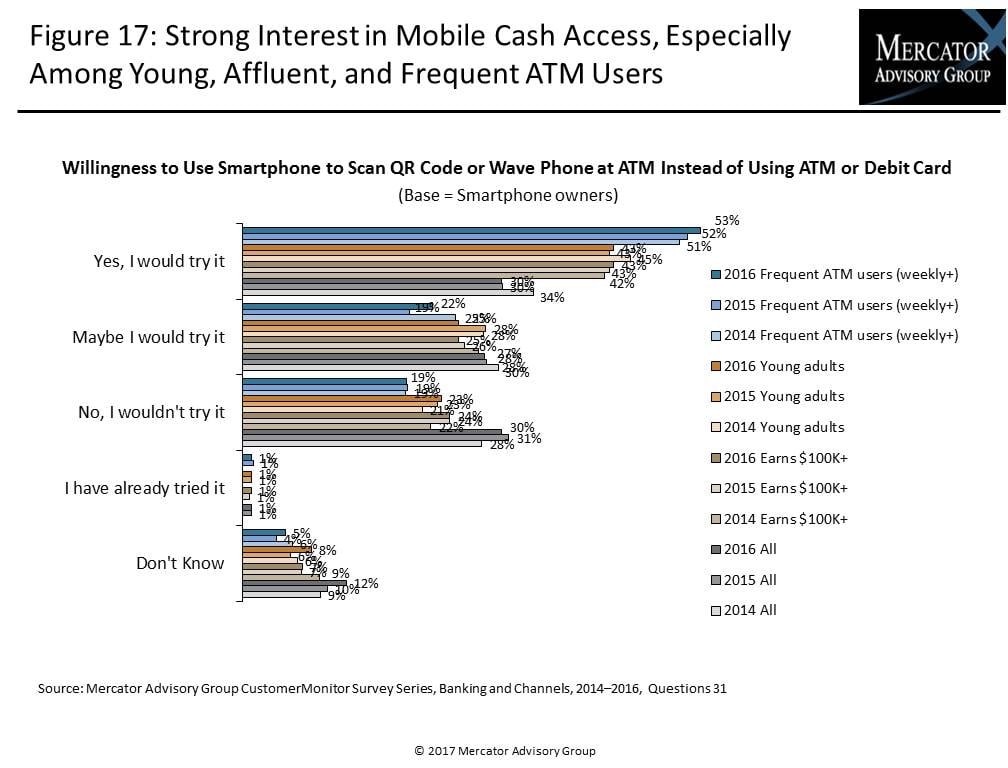

Mercator Advisory Group’s most recent Insight Summary Report, ATM and Self-Service Banking: Key to Engagement, from the bi-annual CustomerMonitor Survey Series, reveals that 30% of U.S. consumers’ would be willing to use a smartphone to scan a QR code or wave a phone at an ATM instead of using an ATM or debit card to withdraw cash. More than 2 in 5 young adults and high-income earners, and more than half of consumers who visit ATMs weekly or more often would be interested in doing so. Given some of the skimming schemes that fraudsters use to copy card credentials at the ATM, “prestaged” cash access using a smartphone to scan a QR code at an ATM can be more secure way to get cash than by inserting a card. This benefit is far and above simply the convenience of not having to find a debit or ATM card to make a withdrawal. When consumers were asked if they would try using this method or if they have tried it already, they were provided a brief description of the process without mentioning any benefits.

Despite several banks recently launching mobile cash access services, very few consumers indicate they have tried it already. Many large banks have just recently launched the program in selected ATM locations and some are beginning to integrate mobile cash access into mobile wallet applications such as Apple Pay.

As self-service banking technology advances, becoming easier to use and offering greater functionality, consumers begin to prefer the convenience of self-service channels to conduct basic banking transactions rather than going to a teller to perform them.

Responses from an expanded sample of 3,000 U.S. adults were collected in the annual online Banking and Channels survey, conducted in November 2016 and are summarized and analyzed in, ATM and Self-Service Banking: Key to Engagement in this latest Insight Summary Report from Mercator Advisory Group’s Primary Data Service.

The study highlights U.S. consumers’ rising use and interest in a wider variety of self-service and ATM channels, especially young adults and mobile banking users. It examines the demographic shift, changing preferences, and use of self-service channels compared to traditional branch banking and identifies trends in consumers’ methods of communicating with their bank and frequency of contact, methods, and preferences for getting cash and depositing checks; changes in use of cash and checks; use of ATMs by type and location; willingness to pay surcharges for convenience; importance of ATM characteristics in new bank selection along with reasons for switching banks.

“Mobile devices are becoming more central to banking and payments and converging with other banking channels to offer greater security and convenience. Any options to enhance convenience and accessibility to their financial institutions and banking functions are welcome,” states Karen Augustine, senior manager of Primary Data Services including the CustomerMonitor Survey Series at Mercator Advisory Group, the author of the report.

The report is 65 pages long and contains 28 exhibits.

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trending of U.S. adult consumer use of self-service banking channels and frequency of use by each method

- Frequency and use of ATM deposits, envelope vs. no-envelope, cash vs. checks

- Demographics of preferred methods of depositing high- and low-value checks

- Shifts in methods of getting cash and depositing checks

- Change in use of cash and checks during the previous year

- Frequency of ATM use and types of ATMs used

- Importance of ATM features and functionality in new bank selection

- Importance of enhanced functionality such as prepaid card loading, payment services, and coupons and rewards offered at the ATM

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world