Overview

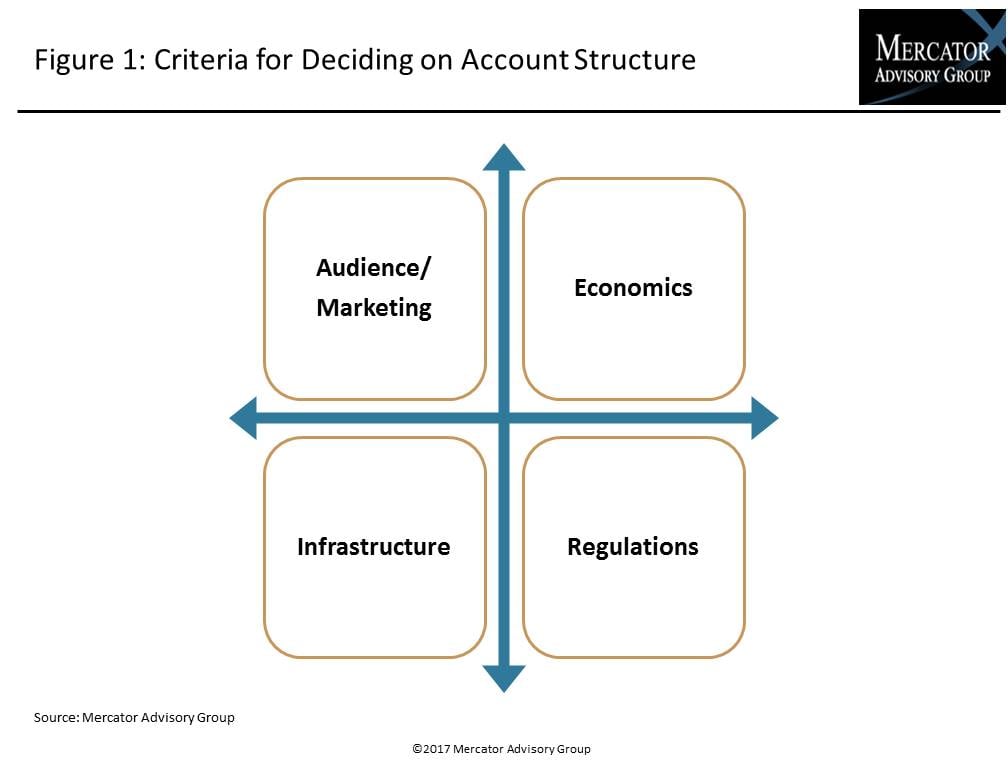

Mercator Advisory Group’s research report identifies key factors that need to be considered when designing a new product. The customer needs, economics, infrastructure, and regulations will all influence which type of account structure makes sense for a new product.

"Prepaid and debit accounts both offer advantages and disadvantages for financial services providers, so understanding the key decision points can lead product designers to the most profitable configuration, " Ben Jackson, director of Mercator Advisory Group's Prepaid Advisory Service, and coauthor of the report, comments.

Companies mentioned in the report include: Chase, ChexSystem, NetSpend, and TSYS.

Members of Mercator Advisory Group's Debit Advisory Service and Prepaid Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

One of the exhibits included in this report:

- The important differences remaining between debit and prepaid account types that can make or break a product

- Details of the key factors to be considered by financial services providers in choosing which account type of deposit/transaction account launch: the audience, economics, infrastructure, and regulations that apply to each account type

- Marketing necessary to show the value of prepaid cards and debit accounts to their likely audiences.

- The importance of developing a comprehensive balance sheet of the revenues and expenses of debit versus prepaid account types to make the right decision on which to launch.

- The necessity of comparing the differing tools required to offer a prepaid card or a debit account with the providers’ existing infrastructure

- The regulations that will heavily influence heavily the success of each product

Book a Meeting with the Author

Related content

January 27, 2026

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

November 06, 2025

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

August 28, 2025

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world