2021 U.S. North American PaymentsInsights: Subscriptions, Bill Pay, and Consumer Fraud Experience

- Date:August 13, 2021

- Author(s):

- Nicholas Bisconti

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group has released a new primary research report titled 2021 U.S. North American PaymentsInsights: Subscriptions, Bill Pay, and Consumer Fraud Experience, summarizing findings from the North American PaymentsInsights survey of 3,001 U.S-based adults. The report aims to highlight the key findings from the survey as they relate to consumer experience with subscriptions, bill pay, and fraud. The report brings together various aspects of how U.S. consumers interact with the payments ecosystem to pay for subscriptions and recurring bills, as well as their experiences with fraud in the past year. The report highlights consumers’ experience and attitudes towards various fraud events, which have seen increased relevance with the radical expansion of card-not-present transactions during the pandemic. Readers are presented with summary findings regarding consumer behaviors and inclinations, as they vary across different demographic cohorts of consumers.

“The accelerated expansion of online shopping and the associated rise in card-not-present transactions during the pandemic has led to an increased incidence of fraud events. This makes it vital for card networks, issuers, financial institutions, merchants, and other players in the payments space to update their fraud prevention solutions to maintain consumer confidence in the safety of their products.” - Amy Dunckelmann, Vice President, Research Operations, Mercator Advisory Group.

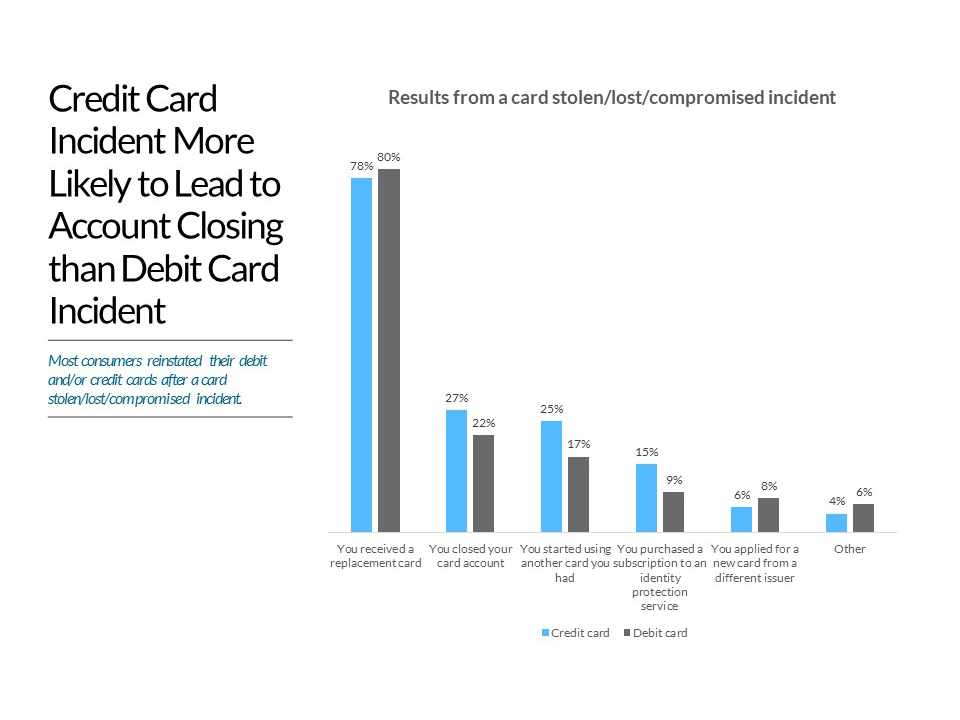

One of the exhibits included in this report:

Highlights of this document include:

• Subscriptions to news and magazines as well as software services had the highest share of consumers paying with credit cards, compared to all other subscription types, 55% and 48% respectively.

• High-income respondents were more likely to pay their bills via automatic deductions from credit or debit card.

• 90% of consumers who pay bills believe that their bills should reach the biller within a single business day.

• Young consumers are more likely to experience fraud of all types, with 46% of 18-34 year-olds reporting to have experienced fraud in the past 12 months.

• Most respondents contacted their bank following a fraud incident involving a P2P money transfer service, with less than half contacting the service in question.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world