2019 Canada PaymentsInsights - Credit Cards: Leading the Charge

- Date:November 22, 2019

- Author(s):

- Peter Reville

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group latest research report presents the findings of a new consumer survey of Canadian consumers. The report, Credit Cards: Leading the Charge, from Mercator’s North American PaymentsInsights survey series, reveals that the credit card is the preferred method of payment both online and offline.

This year marks the first year that Mercator has conducted the PaymentsInsights surveys in Canada. The PaymentsInsights series began in the U.S. a decade ago.

When shopping in stores, 55% of Canadian consumers prefer to use credit/charge cards, followed by 27% who prefer to use debit and only 12% who opt for cash. When shopping online one-half (49%) prefer to use a credit card, and another 12% prefer an online payment service like PayPal.

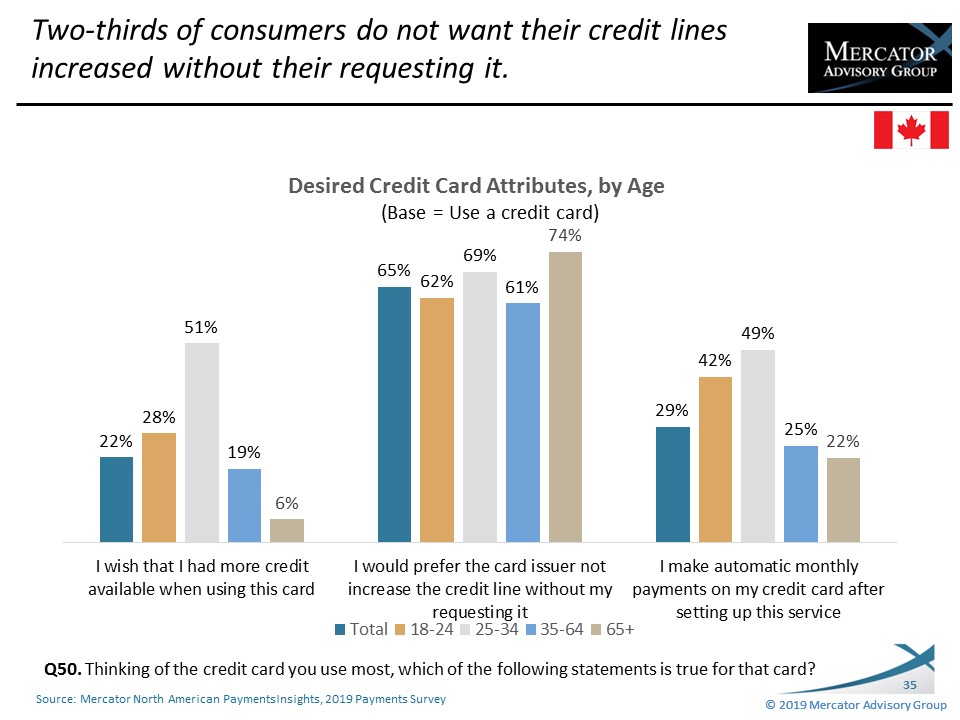

Canadian consumers report that they are not happy with card issuers increasing their credit limits without their approval. Two-thirds of those interviewed reported that they would prefer if their credit card limit were increased only if they ask for it.

About one-quarter of the survey respondents report having experienced some kind of credit card fraud in 2019. Those with annual household income of $100,000 or more are much more likely to report fraud than those whose household earns less.

When paying their credit card bills, the majority of Canadian consumers pay electronically. Two-thirds (66%) pay via online banking, and another 11% pay at the issues website.

With regard to credit card rewards, non-travel points (51%) and cash back (46%) are the most popular credit card rewards programs among cardholders. Among those with household income of $100,000 or more, non-travel related points and travel related rewards are more popular than among lower-income cardholders.

Credit Cards: Leading the Charge, the latest report from Mercator Advisory Group’s Primary Data Service, is based on a sample of 1,004 Canadian adults surveyed in the annual online Payments survey of Mercator’s North American PaymentsInsights series, conducted in June 2019.

The study highlights consumers’ use of credit cards relative to other payment types, the use of credit card controls, reward programs, and new account opening, among other topics.

“We are excited to expand our PaymentsInsights series into the Canadian market. This report serves as a benchmark for continued measurement in Canada. With it, we provide our clients an in-depth view into the credit card market in Canada and the perceptions of consumer about the state of credit cards,” stated the author of the report, Peter Reville, director of Primary Data Services at Mercator Advisory Group, which includes the North American PaymentsInsights series.

Companies mentioned in the survey results shown include: Borrowell, CASH Money, Easy Financial, Fairstone, Fast Financial, Ferratum, Insider Lend Direct, Lending Mate, Magical Credit, MOGO, Motus Bank, SkyCap Financial

One of the exhibits included in this report:

Highlights of this report include:

- Current payment card usage in Canada

- How Canadians pay their credit card bills

- The incidence of fraud

- Merchant influence on card usage

- How consumers use credit card controls

- The current state of credit cards rewards

- Where consumers go when researching a new credit card

- The use of co-branded cards and the benefits they offer

- A view of the use of online lenders

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: Canada: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 22 – 30, 2025, using a Canadian online...

Make informed decisions in a digital financial world