Overview

Mercator Advisory Group has released new research on the U.S. debit cards in the 2019 Annual U.S. Debit Market Data Review. Mercator Advisory Group’s fourth annual review of the market dynamics in the U.S. debit industry focuses on trends and events impacting the industry.

“This report is the fourth annual debit data review compiled by Mercator Advisory Group and new trends continue to influence this very mature payments product,” commented Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report. “The most influential events include the anticipated consolidation of EFT debit networks as their large processor owners propose to merge, the beginning of contactless debit card issuance, the growing influence of debit push payments on network transactions and approaches to battle card-not-present fraud.”

This report has 21 pages and 15 exhibits.

Companies mentioned in this report include: Bank of America, BB&T, Chase Bank, Discover, EMVCo, First Data, Fifth Third Bank, FIS, Fiserv, HSBC, Key Bank, M&T Bank, Mastercard, PayPal, Santander, Shazam, Square, Starbucks, TD Bank, Visa, Wells Fargo Bank, and Worldpay.

One of the exhibits included in this report:

- Review of growth in debit card transactions and dollar volume

- Comparison of debit card growth rate with credit card growth rates

- Where consumers are using debit cards to make payments

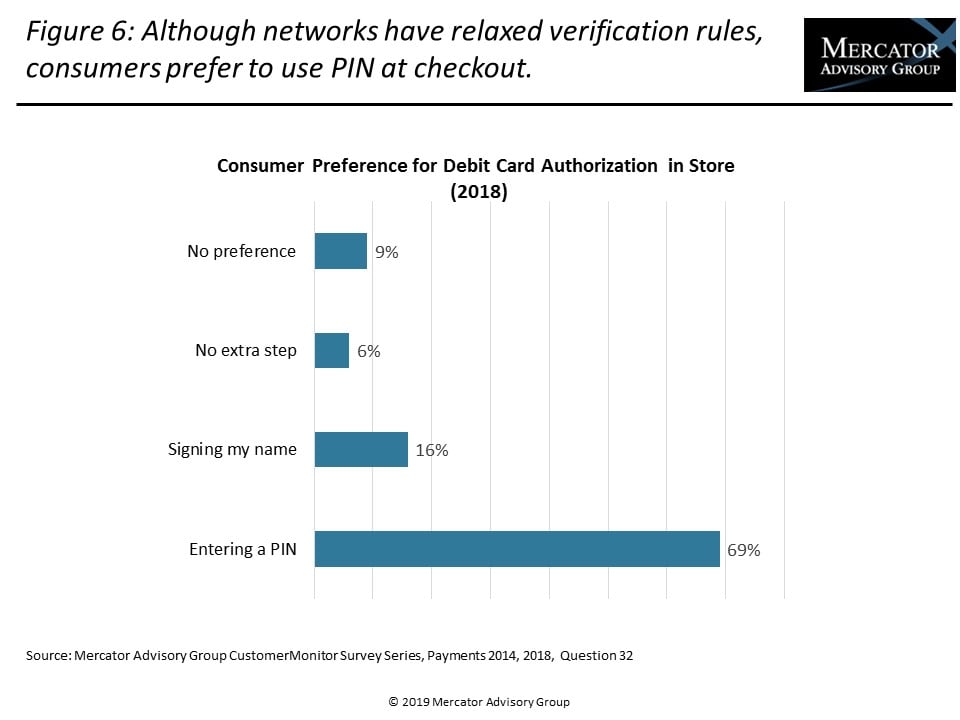

- How consumers are paying with debit, including the impact of signature-less and PINless transactions at the point of sale

- The demographics of a debit card user

- Financial institutions that have announced their intention to issue contactless debit cards

- The visible impact of debit push payments on network volumes

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world