Overview

“Debit card growth resulted in part from consumers turning away from using credit cards for transactions as higher delinquencies and higher interest rates led many to use debit cards instead. Higher costs for everyday items often purchased using a debit card played a role in the growth of the value of debit transactions. Behind the good growth news, debit issuers are contending with near-term concerns including shifting fraud tactics and long term, debit’s role in digital channels and faster payment products as they evolve,” comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This report has 20 pages and 13 exhibits.

Companies mentioned in this report include: Accel, Early Warning, FICO, EMVCo, Exxon, GasBuddy, Mastercard, NYCE, Pulse, Shazam, Star, Target, The Clearinghouse and Visa.

One of the exhibits included in this report:

- Debit card’s standing in relationship with other payment vehicles in the U.S.

- Growth in the number of cards in market

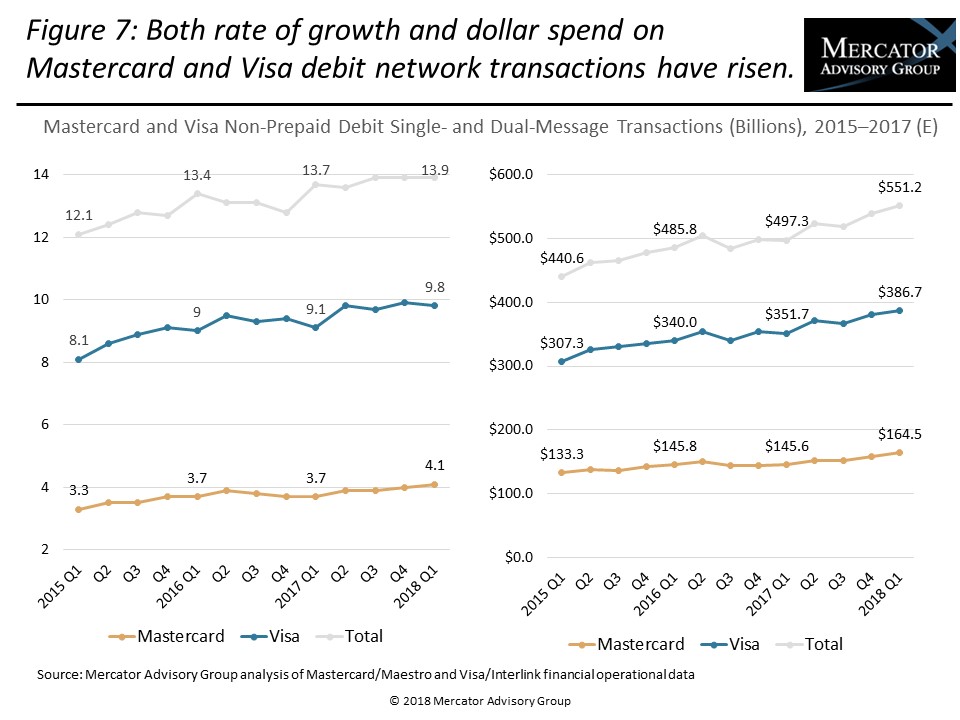

- Transaction and transaction value growth

- The growth of debit card transactions in comparison to credit cards and what is influencing changes

- Discussion of five trends that will impact the debit card market in the near term

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world