Overview

ATMs have evolved over the past half-century from a basic cash withdrawal appliance to the foundation of today’s self-service banking. In new research, 2016 ATM Market Benchmark Report, Mercator Advisory Group reviews how the ATM, mobile banking, and mobile payments are converging for ever-more convenient customer interaction with banks and credit unions.

Cross-channel features have been deployed as well as expanded interoperability with various front- and back-office systems. This report describes examples such as mobile prestaging of cardless ATM cash withdrawals, the potential for person-to-person (P2P) and account-to-account (A2A) transfers, EMV readers, NFC capabilities, and broader systems monitoring capabilities. The report discusses the penetration of these features in ATMs around the world.

This report is 24 pages long and has 16 exhibits.

Organizations mentioned in this report include: Accel, AllianceOne, Bank of America, Credit Union 24, JP Morgan Chase, Cardtronics, CO-OP Financial Services, Diebold, Elan MoneyPass, NCR, Payments Alliance International, PULSE Select, STAR/FirstData, SUM/FIS, Wells Fargo, and Wincor Nixdorf.

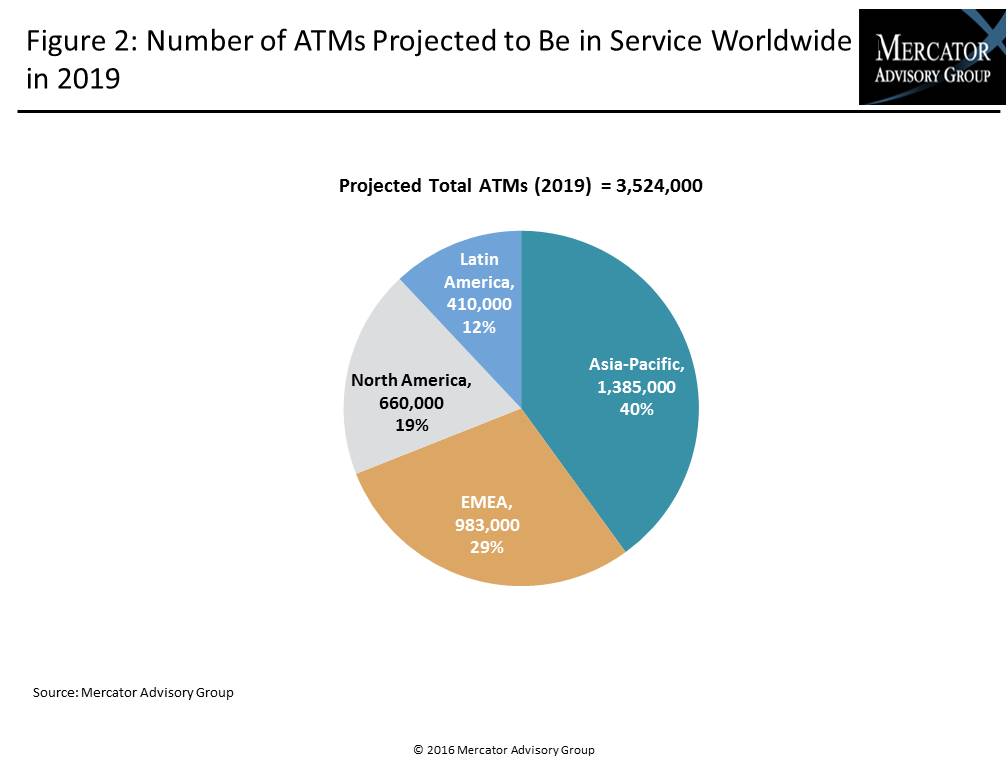

One of the exhibits included in this report:

Highlights of this report include:

- Comparison of rates of ATM growth in various world regions

- Market share of leading ATM deployers in the U.S. by type

- Examples of advanced ATM capabilities being deployed

- Mercator Advisory Group CustomerMonitor Survey results on trends in U.S. consumers’ ATM use, including use of their own banks’ ATMs versus other ATMs and other means of getting cash; frequency of ATM use; use of mobile deposit; willingness to pay for ATM convenience; willingness to try teller-assisted videoconferencing

- Various strategies in use to provide customers surcharge-free access to ATMs

- Discussion of the need for condition monitoring and application performance monitoring

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world