Overview

Decreases in checking account ownership as a result of competition from online-only banks and alternative financial providers, plus Millennials’ professed love for rewards have increased the importance of debit card rewards. Mercator Advisory Group’s research report, 2016 Annual U.S. Debit Rewards Review with U.K. Comparison, examines how the 50 largest banks and credit unions, plus the leading online-only banks in the U.S. are supporting rewards programs to help manage these market forces while balancing challenges with profitability.

“The market is showing greater reliance on merchant-funded discount networks (MFDNs), to defray the cost of rewards. Also, there is a slight shift toward relationship rewards which has some very practical opportunities. It allows financial institutions to promote or deemphasize certain products and services while allowing additional lines of business, to share in the support of these programs,” comments Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and author of the report.

This report also looks at the U.K. market and the role that rewards play in retaining consumers’ loyalty. The U.K. bankers are experiencing unprecedented competition from new financial institutions called “challenger banks” and a countrywide initiative to make it easier and faster for consumers to switch from their current banks to competitors.

This report has 19 pages and 9 exhibits (including 3 appendix tables with reward program details).

Companies mentioned in this report include: Ally Bank, BB&T, Bank5 Connect, Bank of the Internet USA, Barclays, Capital One, Charles Schwab, Discover, Federal Reserve Bank of Philadelphia, Financial Conduct Authority, HSBC, Lloyds, RBS, World Bank, and more.

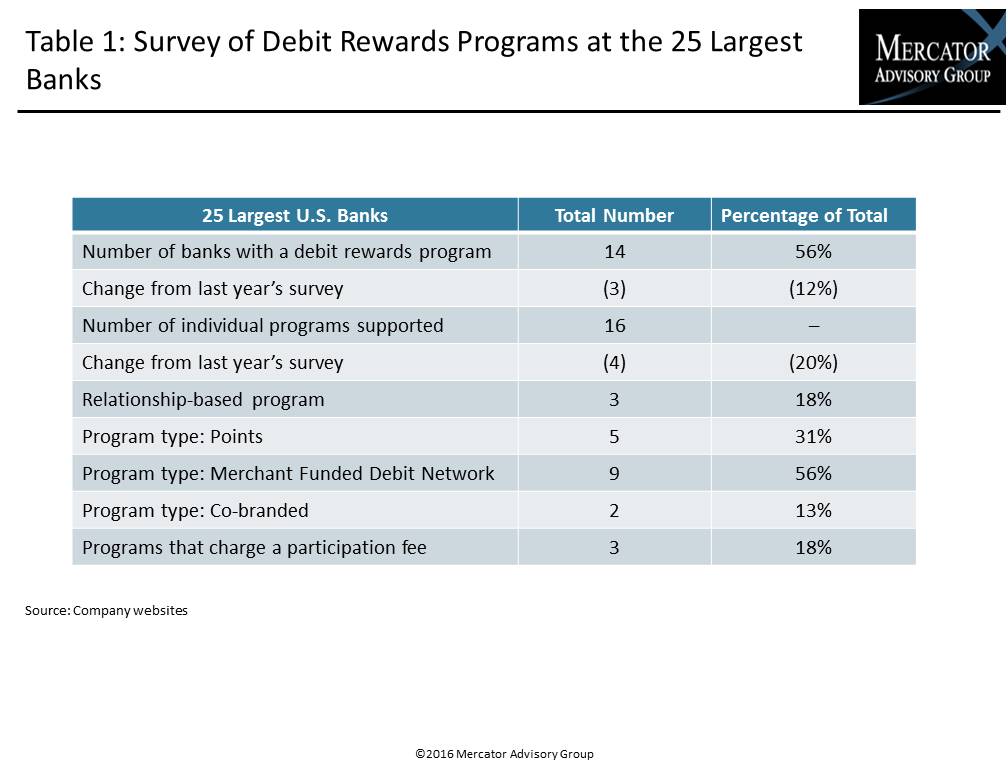

One of the exhibits included in this report:

Highlights of the report include:

- Understanding the evolving consumer trends in checking account ownership in the United States

- Changes in debit card ownership and usage

- Review of market forces that impact debit rewards

- Trends in the use of merchant-funded discount networks and relationship rewards

- A survey of debit reward programs at the 25 largest banks and 25 largest credit unions in the U.S.

- A comparison with U.K. banks and their use of account rewards

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world